Energy and Gold Ltd., Released on 09/17/18

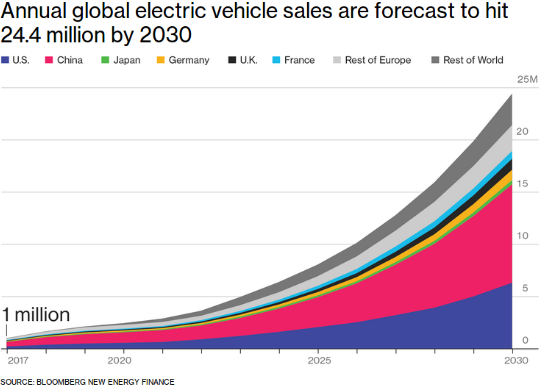

Global demand for copper continues to surge on the back of growing electric vehicle demand, and this demand is forecast to continue to grow over the next couple of decades. China’s “Belt and Road Initiative” (project aimed at connecting infrastructure corridors within China) is also estimated to generate another 2.2 million tonnes of copper demand (US$13.3 billion at US$2.75/lb copper) between now and 2030.

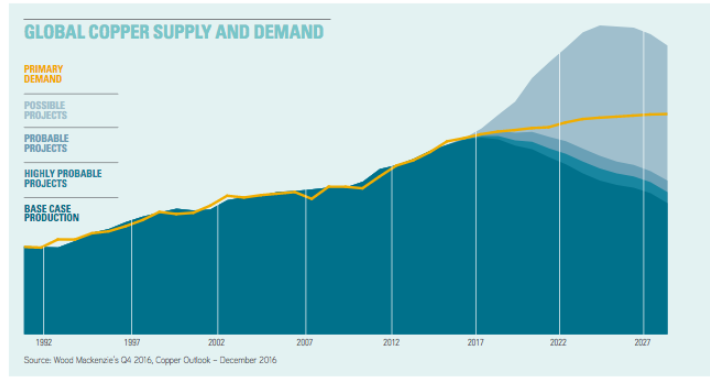

We know that the world is growing and China and India are spending heavily on infrastructure upgrades which inevitably consumes enormous amounts of copper. Moreover, A boom in demand underpinned by renewables, global electrification, and electric-vehicles will not be offset by committed new mine and scrap metal growth. This likely means that the copper price will need to move high enough in order to incentivize marginal projects to come online. However, this is not a simple solution because of mining lead times (it takes a minimum 5-7 years to go from pre-feasibility stage to production). This means that those marginal projects are going to need to come online right now in order to fill the projected 2025 gap.

Many of the “possible projects” in the chart above are massive projects that have two things in common: 1. Permitting challenges and 2. Enormous capex requirements. Investors who want to profit from surging global copper demand need to find projects that will be able to turn on production as global demand kicks into overdrive, and supply drops off, in 2022/23 and beyond.

According to this forecast for global electric vehicle sales, electric vehicles will account for an additional 300 million kilograms of copper demand by 2023 (75kg per EV x 4 million additional electric vehicles).

The few massive lower grade copper projects out there such as Northern Dynasty’s Pebble Project in Alaska not only have multi-billion dollar capex requirements but most of these projects are facing 7-10 permitting processes which makes it unrealistic that any of these projects will be able to move into production before 2030. This leaves much of forecast deficit left to be filled by existing mine upgrades (which are quite costly) and smaller, but higher grade projects which are currently in the development stage.

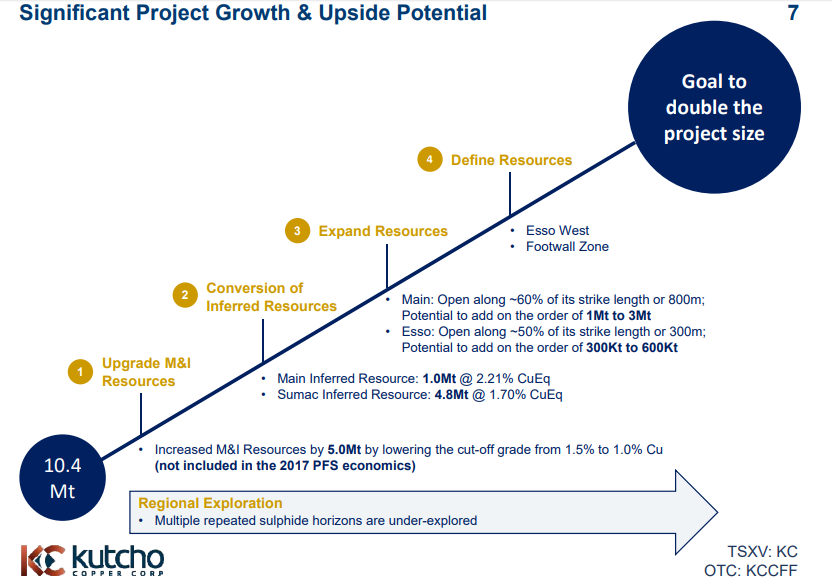

One such higher grade copper project which has a relatively fast track to production (~5 years) is Canadian copper developer Kutcho Copper’s (TSX-V:KC) Kutcho Project in British Columbia, Canada. The Kutcho Project boasts an average grade of nearly 3% CuEq (2.92%) across the project’s probable reserves of 10.4 million tonnes. Kutcho is currently in the midst of an infill and exploration drilling program with the aim of delivering an updated resource estimate by Q1 2019.

Kutcho just released an initial program update including some infill holes recently drilled which included drill hole KC18-038-W1 which returned 28m of 2.09% Cu, 6.1% Zn, 65.8 g/t Ag and 0.82 g/t Au or a CuEq of 5.7% including a 10.4m massive sulphide intersection of 3.80% Cu, 14.4% Zn, 134.6g/t Ag and 1.84g/t Au or a CuEq of 12%*. Kutcho Copper President & CEO Vince Sorace had the following to say regarding mineral resource expansion drilling at the Kutcho Project:

“We have now moved into an exciting phase of the field program as the mineral resource expansion drilling at Kutcho is now in full swing and we anticipate releasing drill results frequently over the course of the next few months. The initial drill holes from Esso represent the unique high-grade opportunity achievable at the Kutcho project.”

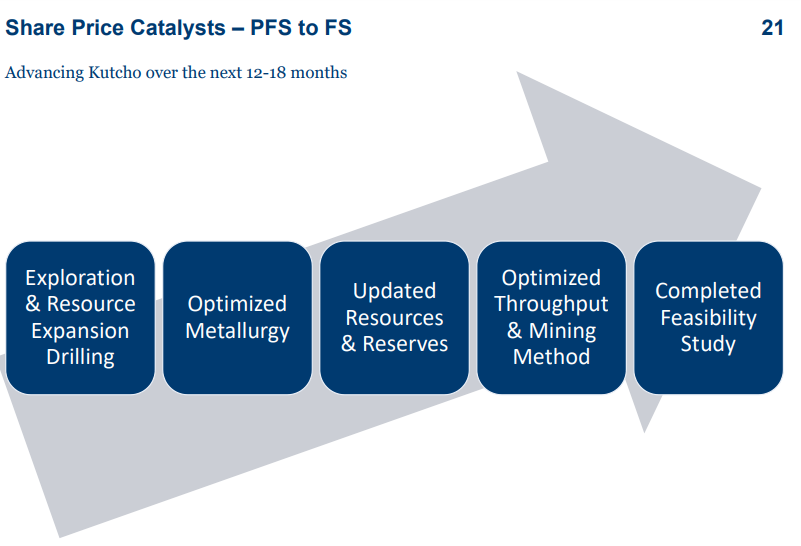

Kutcho is in a potentially transformative sweet spot right before it delivers a feasibility study for the Kutcho Project in Q2 2019; by the end of Q1 2019 Kutcho Copper will have completed resource expansion & exploration drilling, a metallurgical process optimization program, and an updated resource estimate. Meanwhile, behind the scenes Kutcho has been working on environmental assessments and its relationships with the local First Nations.

Given the Kutcho Project’s location in mining friendly British Columbia in an area with several other operating mines including Imperial Metals’ Red Chris mine, mine permitting isn’t expected to be a difficult process. This means that once KC delivers its feasibility study in the middle of next year the company could be as little as two years away from having a fully permitted high grade copper project in one of the best mining jurisdictions in the world.

There are numerous catalysts over the next year that could help Kutcho Copper shares see an upside rerating:

We will know a lot more in a few months, however, Kutcho Copper’s goal of doubling the size of its resource is far from unrealistic:

At KC’s current share price of C$.325 (C$18.2 million market cap) the market is valuing KC shares at less than 10% of the Kutcho Project’s after-tax NPV(8) of C$265 million (using US$2.75 copper, and US$1.10 zinc). Using the prefeasibility study economics the Kutcho Project is expected to have a 12 year mine life with 2,500 tonne per day production rate for a total life-of-mine payable production of 378 million pounds of copper and 473 million pounds of zinc, with average annual production of 33 million pounds of copper and 46 million pounds of zinc.

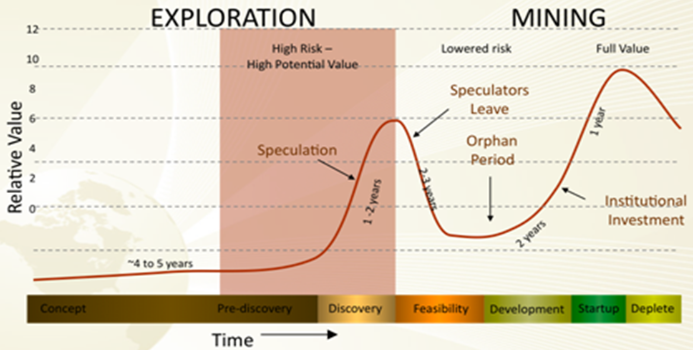

If Kutcho can increase the mine life by increasing the size of the deposit it can improve project economics further, thereby making KC shares even cheaper than they are already. Moreover, the estimated initial capex of C$220 million is a much more attainable hurdle to jump over than many of the multi-billion dollar low grade copper projects that are sitting out there around the world. It still feels like Kutcho is in the so called “orphan period” between project feasibility and project development:

While Kutcho Copper shares may not be very sexy to investors at this exact moment in time, they could begin to look a lot more attractive once Kutcho has delivered an updated resource estimate and a final feasibility study (some copper sector tailwinds wouldn’t hurt either…).

Original source, published September 17, 2018: energyandgold.com/2018/09/17/

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Kutcho Copper Corp. is a high-risk venture stock and not suitable for most investors. Consult Kutcho Copper Corp’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated for marketing & promotional services by Kutcho Copper Corp. so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.