Critical Investor, released on Jan 17, 2018

Kutcho project

1. Introduction

Very rarely I come across a junior that simply seems to tick almost all boxes, and it looks like new sponsor Kutcho Copper (KC.V) is doing just that. From project profitability to management, from financials to geology, from location to metal prices, it comes across as a genuine display of quality and excellence. CEO Vince Sorace certainly made the most of Capstone Mining’s strategy change a few years ago not to develop relatively smaller, non-core assets, and now looking to divest assets to clean up their troubled balance sheet.

In an impressive stream/convertible debt/equity deal with Wheaton Precious Metals to the tune of C$120M, Sorace managed to buy the Kutcho Copper Project outright in C$28.8M all cash plus an equity interest in the new to be formed company from Capstone, when Kutcho Copper still was predecessor Desert Star Resources, with a market cap of only C$10M at the time. As a consequence, the company is also fully financed to the FS under the current mine plan. I can’t recall (I’m in this industry since 2010) ever having seen deals being done that are so much bigger than the involved junior itself, and are so well structured, with such a quality asset, so as far as I am concerned this should be a prime candidate for deal of the year for 2017.

Although Sorace would certainly deserve all the acclaim for this deal he could possibly get, the main purpose of this article is of course providing an outlook on upside potential for investors. When management would decide to just advance the project, which already boasts an excellent 2017 Pre Feasibility Study (PFS), to Feasibility Study (FS) stage and having it fully permitted, there is already realistic potential for a double at current strong (and expected to go higher) base metal prices. But there is more. The company has several possibilities to include considerably more resources into the mine plan, which could increase the Net Present Value (NPV) of Kutcho Copper significantly. In this analysis I will discuss this potential, compare the company with peers, and indicate valuation upside.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. Company

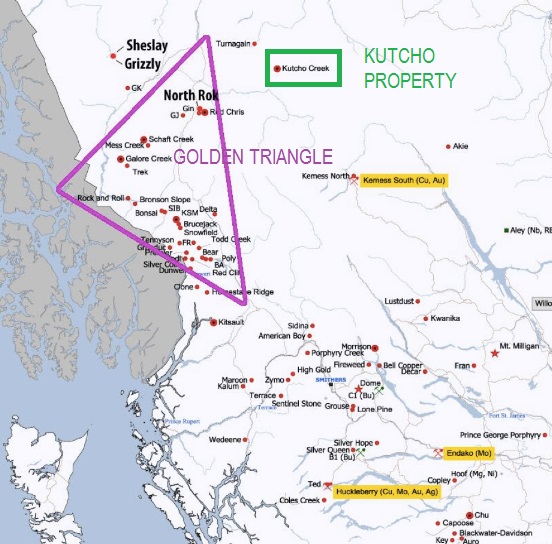

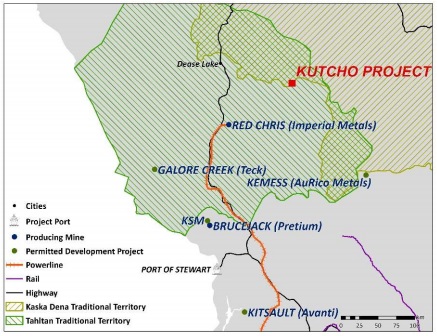

Kutcho Copper Corp. is a Canadian resource development company focused on expanding and developing the Kutcho high grade copper-zinc VMS project in northern British Columbia. The project is located nearby the richly mineralized Golden Triangle Zone, in hilly/moderately mountainous terrain. As can be seen below by the number of projects and mines, British Columbia is a familiar mining jurisdiction, and has a solid ranking on the Policy Perception Index according to the last Fraser Survey of Mining Companies, coming in at #41 out of 104 jurisdictions worldwide.

Location map: Kutcho Copper: Kutcho project

The company signed a definitive agreement with Capstone Mining to acquire the Kutcho high grade copper-zinc-gold-silver project for C$28.8M and a 9.9% equity interest in Kutcho Copper, and at the same time released an updated PFS on June 15, 2017, which showed excellent figures. Seeing this being done at the same time is pretty unusual as well, but definitely confirms the can-do mentality of Sorace and his team for me. The base case scenario generates an after-tax NPV8 (8% discount) of C$265M and an after-tax IRR of 27.6%, using metal prices of US$2.75/lb copper, US$1.10/lb zinc, US$17.00/oz silver and US$1,250/oz gold and a currency exchange rate of 0.75 USD/CAD. This is all based on a modest initial capex of C$220.7M which is well below base case NPV, which is a strong feat for a base metal project in general. With current (much higher) metal prices this already proves to be a conservative PFS, and there is much more upside. More on this later.

Kutcho Copper could buy this asset as it made an impressive set of deals with Wheaton Precious Metals, formerly known as Silver Wheaton, and raised cash in the market. Besides the streaming deal which will provide US$65M for FS, permitting and early construction, a combination of a C$20M convertible debt loan and a C$4M equity financing with Wheaton, plus a mostly brokered C$14.7M equity financing (the aforementioned C$4M Wheaton equity was included here) provided for the C$28.8M cash component in order to acquire the Kutcho project from Capstone. I followed it closely and was amazed at the achievements, as I know how hard it can be for juniors to just raise a few million dollars. The Wheaton deal obviously opened many doors.

After closing the acquisition on December 15, 2017, which happened just a week after raising the C$14.7M, Kutcho Copper commenced trading on December 21, 2017 at the TSX Venture Exchange under the ticker KC.V.

As of January 16, 2017, Kutcho Copper has a share price of C$0.76 and a market cap of $36.82M, with only a very tight 48.45M shares outstanding (fully diluted 70.42M, all options and warrants out of the money at C$1.00, expiry in 3 years). The average volume since trading on December 21 is a pretty liquid 475,000 shares.

Share price over 1 year period

As soon as the trading halt was lifted, the markets showed a lot of interest, and as I strongly believe the stock to be substantially undervalued at the moment, I see Kutcho Copper shaping up as one of the go-to base metal projects for the coming years.

Kutcho Copper has an estimated $4M in cash at the moment, and C$20M in debt. Management and Board controls 10% of shares which is good to see, Wheaton Precious Metals holds 13% and Capstone Mining is the largest shareholder with 16%. There are 17.65M warrants, of which 6.37M are in the money and 3.4M of those will expire before the end of August. The balance has an expiry in 3 years @ C$1.00. The options have an average life of 4.25 years with a weighted average price of $0.62.

The management team and the board of directors consist of some very experienced quality people. For starters there is President and CEO Vince Sorace, who has been around for 25 years in the mining business, having raised over C$200M and founded various private and public resource companies. He managed to attract a few very interesting names to his team, as there are two key people from former high flyer Kaminak Gold: VP Community & Environment Allison Rippin Armstrong, and VP Exploration Rory Kutluoglu. COO Rob Duncan is also a household name in mining, having done a lot of exploration for majors including Rio Tinto and Inmet, with a lot of specific VMS experience. Eva Nakano does Corporate Development, and it’s the first time I see this job being done by someone who is a Professional Geologist with an MBA.

Recent additions are Len Holland and Angus Christie, no newcomers either in the mining industry. Holland led the re-commissioning of Trevali’s Caribou project, consults to Glencore, SNC Lavalin and First Quantum Minerals among others, and will lead the optimization of metallurgical processes. Christie, who led the Feasibility Studies by JDS for Sabina Gold&Silver and Kaminak Gold, will oversee the Feasibility Study process for the company. These two experts further complete and solidify one of the best technical teams possible.

The Board of Directors consists among others out of Stephen Quin, the current CEO of Midas Gold (who is also the former President and COO of Capstone Mining, and former President and CEO of Sherwood Copper, which amalgamated into Capstone during his tenure), Bill Bennet, former BC mines Minister for 3 periods, helped launch BC’s First Nations mine revenue sharing program, and Brad Mercer, who leads exploration at Capstone Mining, who also managed the Kutcho field program in 2010 that contributed to the 2011 PFS for Capstone at the time.

The Advisory Board has also three notable and very experienced names on board, as there are Peter Meredith, former CFO and Deputy Chairman of Ivanhoe Mines, Rob Carpenter, co-founder and long time President and CEO of Kaminak Gold, and Tookie Angus, current Chairman of Nevsun Resources and former Managing Director of Mergers & Acquisitions for Endeavour Financial, and former Head of the Global Mining Group for Fasken Martineau. With Sorace having arranged all financings necessary to complete the feasibility study under the current mine plan, I can’t think of a better team to handle exploration, project development and permitting.

I guess by now it becomes clear why I am pretty enthusiastic about Kutcho Copper, but first I will discuss the basics like the deals and main metals copper and zinc, before I delve into project, project economics and potential upside.

3. The Deal And The Financings

The acquisition of the Kutcho project by predecessor Desert Star Resources was a relatively straightforward deal, as the majority was cash, as can be seen in the summarized terms of the agreement as per the news release of June 15, 2017:

Desert Star to acquire 100% interest in Capstone’s wholly-owned subsidiary Kutcho Copper Corp. which holds 100% interest in the Kutcho project

Desert Star to pay Capstone C$28.8 million cash upon closing

Capstone to become 9.9% shareholder of Desert Star at the completion of the Acquisition

The shares issued to Capstone, will be restricted from sale for a period of two years from the date of issuance. Upon termination of the pooling restrictions, Capstone must give the Company written notice of its intention to sell any of the Purchased Shares, and Desert Star will have a 10-day right to designate the purchaser of such shares.

For so long as Capstone holds at least 5% of the issued and outstanding shares of the Company, Capstone will retain the right to:

– Appoint one director to Desert Star’s board; and

– Participate in any subsequent security offerings on a pro-rata basis in proportion to Capstone’s beneficial ownership interest in the Company’s outstanding shares immediately prior to such offering

If the closing of the Acquisition has not occurred on or before August 31, 2017, either Capstone or the Company may elect to terminate the Agreement

The C$28.8M cash component was puzzling to me when I first read about the intended acquisition, as normally it would be extremely difficult for an almost inactive C$10M market cap junior to raise that kind of money, not even taking into account the resulting amount of dilution. Therefore, the involvement of Wheaton two months later was quite a surprise.

The 9.9% stake of Capstone and a Board seat reinforces the relationship between the two companies, as director Quin was the former President and COO of Capstone, and already had the Kutcho project under his supervision as the CEO of Sherwood before it amalgamated with Capstone. VP Exploration of Capstone Brad Mercer is the representative for the 9.9% interest of Capstone in Kutcho Copper.

The last highlighted term turned out to be a formality, when the C$65M streaming deal with Wheaton was announced, Capstone was more than happy to initially extend the deadline to September 30, 2017, and extended this further into December later on, as CEO Sorace provided enough convincing arguments to do so.

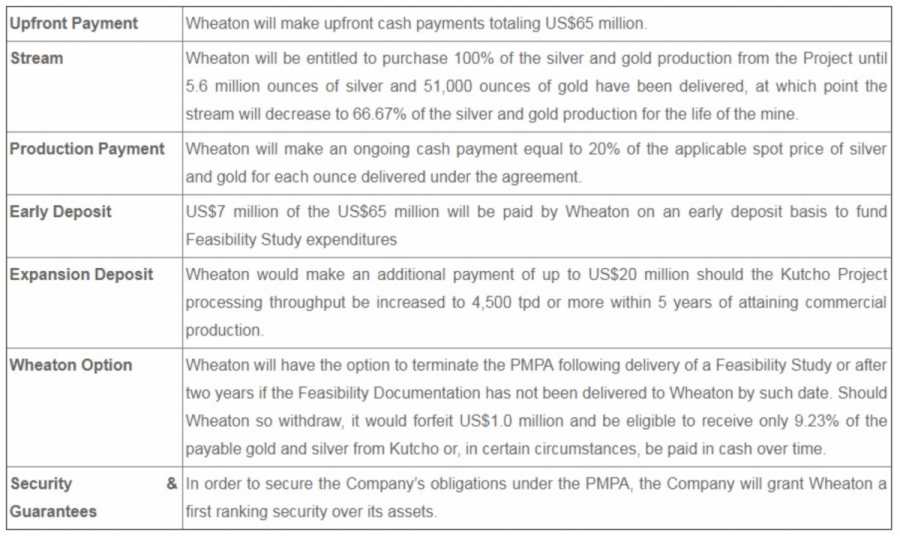

The first streaming deal with Wheaton was already impressive, as Wheaton has the reputation of doing thorough due diligence. Here are the highlights:

These terms are not too different compared to other deals. For example, the ongoing cash payments for silver come in at 20% at the Glencore-Wheaton deal (US$900M upfront cash).

In addition to this, Wheaton also agreed to participate in up to 14% of a proposed equity financing to a maximum of C$4M, proceeds to be used for the acquisition of the Kutcho project. This, and the US$7M upfront for FS expenditures were quite important in my view to convince participants in the pivotal C$14.6M round later on.

Another agreement very important for this round was the C$20M convertible debt loan with Wheaton, announced on October 31, 2017, which was fully backstopped by Wheaton, second lien to the US$65M stream and bears 10% interest per annum. This provided for the majority of the C$28.8M acquisition price for Kutcho in cash. The conversion price is a 25% to 30% premium to the price of any concurrent equity financing.

This equity financing was the C$14.6M round as mentioned before, priced at C$0.65 with half a warrant (@C$1.00, 3 years expiry). The money was raised by a syndicate lead by Macquarie, consisting of BMO, Haywood and PI Financial, and was the biggest risk in my opinion as everything else depended on it. CEO Sorace came through with flying colors, the acquisition of the Kutcho copper-zinc-silver-gold project could be finalized and Kutcho Copper was born.

Because of this deal, Kutcho Copper doesn’t have to finance US$57M of capex by itself anymore (US$65M Wheaton stream minus US$8M of FS expenditures), which according to rules of thumb of 2/3 debt-1/3 equity would save the company about US$20M in dilution (which is about C$25M) in the long run.

An old, still existing back-in right of Royal Gold for 50% for 300% of eligible expenditures triggered at the FS isn’t likely to be executed anytime soon. First, the back-in right is not on the entire deposit; it is only on a portion of the deposit. Royal Gold’s 50% of that portion amounts to 24% of the project. At the moment, the eligible expenditures are sitting at $50M and this will be increasing with another estimated C$12-15M. Therefore, their back-in payment would be at least C$150M and likely up to C$195M. If Royal Gold choses to back-in, they would additionally be responsible for their 24% of initial capex, so on a C$220.7M capex that is an additional C$53M, resulting in C$203-248M payments.

On a $265M NPV it doesn’t make much sense for Royal Gold to pay that kind of cash for only 24%, which is just C$63.6M. Even at an NPV of about C$800-1000M it would mean just break even for Royal Gold, but capex increases with the expanded scenario which would be needed for these kind of NPV numbers, so the needed NPV needs to be significantly higher before they would be interested. According to my modeling later on in this article, an NPV of C$800M comes close to the best scenario at C$3.75/lb copper, so never say never but it seems like this could only become a realistic scenario at C$5.00-5.50/lb copper.

Talking about copper, let’s have a look at the main metals of the Kutcho project.

4. The Metals: Copper And Zinc

The primary revenue generator of the Kutcho project is copper, followed by zinc, both accounting for about 92% of total revenues. According to the 2017 PFS, the majority (about 66%) of copper-zinc revenues for the Kutcho project is generated by copper at a US$2.75/lb copper price and a US$1.10/lb zinc price.

Copper

Copper is a well-known metal as it is used for many purposes (electronic devices, power cables, cars, plumbing, dynamo’s, building parts, etc.). Copper is deeply tied to the Chinese economy, which uses about 40% of global supply. The trading and pricing of copper has become an indication of the overall health of the Chinese economy. Before that, it more or less did the same for the world economy, hence the name “Dr. Copper”.

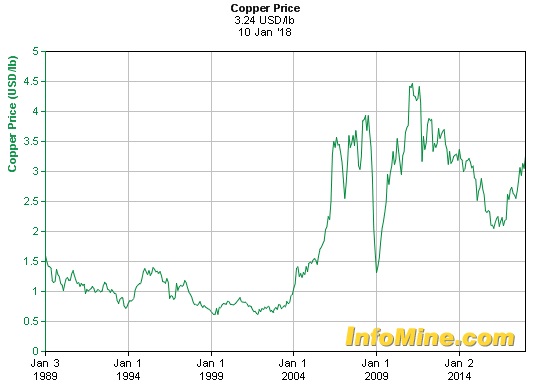

Since 2001, the price of copper increased dramatically, following the development and growth of China. However, this growth path didn’t appear to be sustainable for the long term, and China is currently switching from an exporting producer to a consumer oriented economy.

Copper price history

Since copper has been or is still used (little do we know) as collateral in many financings in China, it could very well be that large, hidden stockpiles still exist. A side effect of this function as collateral is that the perception of “Dr. Copper” changed, and cannot be used anymore to simply gauge the state of the Chinese economy, let alone the world economy. It becomes more of an indication of speculation on copper.

Notwithstanding this, as the Chinese economy and the world economy in general are doing well and keep improving, overall demand for copper seems to have picked up again since the beginning of last year. This has been fueled by several events and developments, as there were strikes at some of the largest mines, Indonesia temporarily halting exports of concentrate, improving Chinese growth figures, Trump’s tax cut plans, Chinese efforts on limiting pollution affecting smelter operations and the ongoing paradigm shift towards electrification of society (electric vehicles, solar, wind, grid storage, batteries, etc) which will involve a significant increase in copper demand.

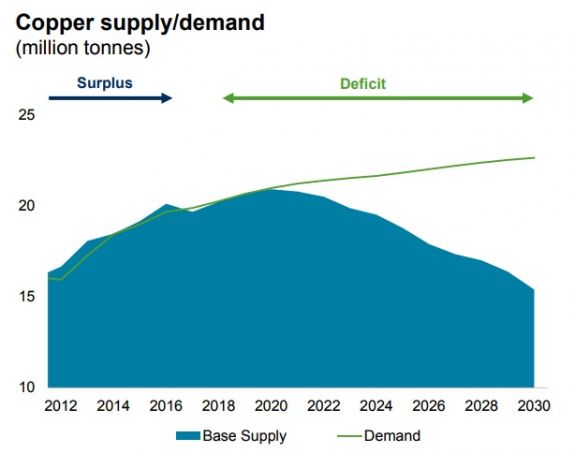

At a longer timeframe it is well known that the average grade of existing operations and their reserves keep dropping, impacting output. Besides this, it is also a problem that new projects aren’t discovered fast enough to keep up with ever rising demand. Codelco, one of the biggest copper producers globally, is currently investing up to $25B in its existing mines just to keep production levels intact. Another development is the increasing time from discovery to production, due to needed increasing size of projects, as lower grades result in increasing need for economies of scale, and this in turn leads to huge projects that are hard to develop, permit, finance and construct, especially since many jurisdictions hosting large copper resources are becoming more hesitant on increasing environmental concerns. This is all believed by analysts to lead towards a supply crunch for copper in a few years, widening to a massive 7-8Mt deficit by 2030:

Copper supply/demand; Rio Tinto presentation, source: Wood Mackenzie Q3 2017

2030 is a long way out from today of course, and part of the copper price is speculation, but it does look like Kutcho Copper is positioned well when aiming for a production decision in 2-3 years.

Zinc

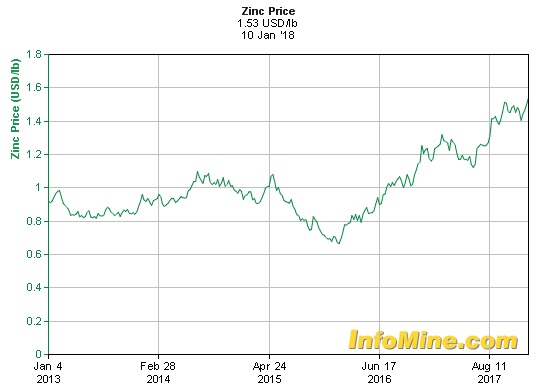

A chronic shortage of supply of zinc is well underway now. The coincidental closure of major zinc mines (Brunswick, Perseverance, Century, Lisheen, Skorpion) through depletion during 2016, taking 500kt per annum off the table, resulting in a widening supply/demand deficit and lowering LME stocks to critical levels, and coupled with new capacity not coming online before the end of 2018, the outlook for the zinc price in 2018 looks strong. The price of zinc already ran up from US$0.67 to a recent US$1.53/lb, and is forecasted to go up even more this year, possibly even to US$2/lb:

The zinc market has been in deficit for a long time (since 2012), but only since the end of 2015 did the zinc price start to appreciate, probably due to covert Chinese stockpiles which finally seemed to be depleted by then. Chinese stockpiles are always a possibility with any Chinese supply and/or demand dominated commodity.

Here is a chart from Kitco.com, indicating long term weakness in LME inventories, but only since the end of 2015 coinciding with factors like production going off line:

It seems like the stocks are heading for new lows, and recently broke through the 200,000t levels, and dropped below the 10day supply threshold which is deemed to be critical. China has also been shutting down numerous mines due to safety and environmental concerns. However, there are developments going on which could balance the current supply/demand deficit in a few years. Glencore is bringing back online a staged annual 130,000t of production at its Lady Loretta mine located in Australia, commencing in Q4, 2018 and at full production at the end of 2019.

Another mine is the Dugald River mine, owned by Chinese giant MMG, which would add 170,000t annually, also located in Australia. Notable operators looking to expand existing mines are Teck and Hindustan Zinc, adding another estimated 170,000t. This is also planned for late 2018 or the beginning of 2019. As total zinc production is about 14Mt per year, adding 470,000t doesn’t sound much but the earlier cutback of 500,000t was able to send the zinc market in a serious deficit. Big question will be what (Chinese) demand will look like when new supply starts to come online. As zinc is primary used for galvanizing steel, its demand is tied to general economic growth. At current growth rates, which aren’t accelerating yet and are modest, I see the zinc price coming down again after a peak somewhere this year, but could probably hold on to levels above US$1.10-1.20/lb for the longer term, as I don’t view the forecasted additional production coming online capable of creating a big surplus.

As the majority of revenues is generated by copper, the outlook for the long term economics of this project is strong in my view.

5. Project

The Kutcho project is located in northern British Columbia, approximately 100 kilometres east of Dease Lake and Highway 37, and consists of one mining lease and 46 mineral exploration claims encompassing 17,060 Hectares. The site is accessible via a 900 m long gravel airstrip located 10 km from the deposit and a 100 km long seasonal road from Dease Lake suitable all year for tracked and low-impact vehicles, and trucks in the winter period. The road and airstrip obviously have to be upgraded for a mining operation, and this is taken into consideration in the 2017 PFS, which will be briefly discussed later on.

I wondered what exactly the need is to upgrade the airstrip in BC which has some remote areas but isn’t exactly the middle of nowhere, and management had this to say: “It is very inexpensive to upgrade the airstrip such that it can be used for efficient mining crew rotations. That way scheduled flight service can pick workers up in towns far away such as Smithers, Terrace, and even Vancouver and a crew change out can still be completed in one day. The second, and very important, reason for the airstrip is that it provides a rapid way to get medical aid in and out if there is a serious incident on site. Lastly, it means less traffic on the haul road.” Fair enough.

Questions on a potential impact of a winterbreak were also quickly answered by management. They have planned the scale of the program such that they can achieve all the technical data collection for the feasibility in one field season. Allison Armstrong is also completing a Gap analysis going back from 2017 to 2011 for environmental permitting requirements, and all of that data can also be collected in 12 months. There isn’t really a winterbreak although the easy field season up there is May 21 to October 31. Outside this window, things are not impossible, just more expensive. Environmental monitoring occurs year round with data downloads and monitoring monthly. These are simple skidoo or helicopter trips in the winter months.

Management will complete all drilling requirements June 1st to Sept 30th with up to four drill rigs. Therefore Kutcho has some safety margin before things become more expensive.

The project has a long history, as mineralization was discovered back in 1968, and Sumitomo and Esso started developing the project from 1972 to 1989. From then onwards, Kutcho sees a number of different owners, where it always had a non-core position, or metal prices didn’t justify further development. The last owner Capstone didn’t develop it further after a positive 2011 PFS as it changed up its strategy towards larger projects, buying for example Santa Domingo and Pinto Valley, and shelving Kutcho. A few years ago balance sheet issues emerged, and eventually forced Capstone into recently selling the project.

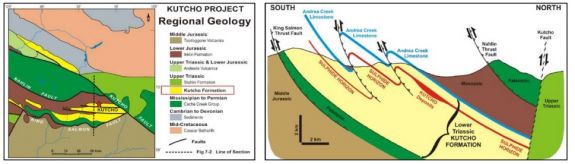

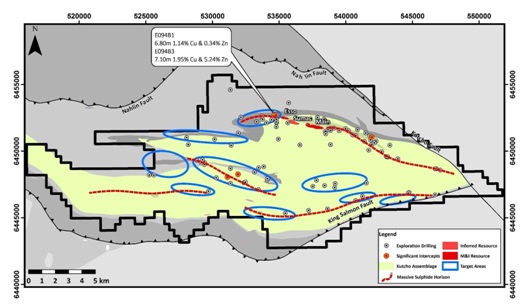

Mineralization at Kutcho comprises three known “Kuroko-type” volcanic massive sulfide (“VMS”) deposits aligned in a westerly plunging linear trend. VMS deposits are sought after as they usually occur in groups, close to each other. Features of the Kutcho deposits suggest that they formed at or near the water-seafloor interface in a structurally controlled depression.

The red sulphide horizons in the right diagram host the mineralization for Kutcho. The chemical composition of the alteration around the Kutcho deposits is well zoned around the hydrothermal vent areas. For readers with geological knowledge: mineralization consists of a pyritic footwall with zoned copper and zinc towards a sharp hanging wall contact.

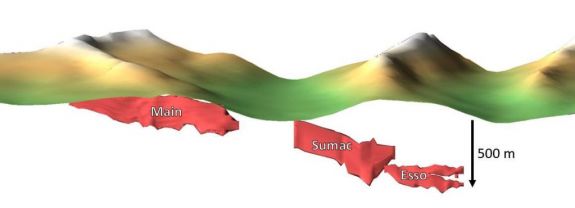

The largest deposit, Main, comes to surface at the east end of the trend, with Sumac followed by Esso down plunge to the west.

Although Main dips to about 250m below surface, the operation will be largely an underground mine, with only in the first year a starter pit. The proposed mine only handles the Main and Esso deposits, as Sumac hasn’t been sufficiently delineated (just Inferred). The Esso deposit is located about 2km on strike from Main, and a possible upgrading and including Sumac into the mine plan could result in some likely development cost savings at Sumac.

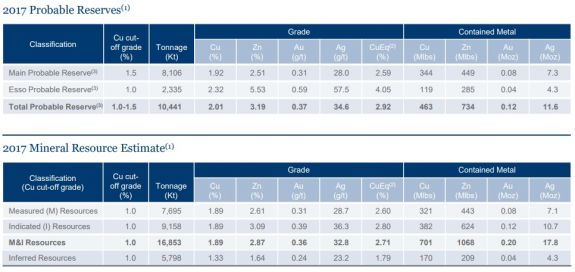

The Kutcho project has a decent resource estimate, completed in 2017, and although the pounds of copper don’t exceed the 1B pounds (for comparison majors are looking for 5-10B pound deposits), the grade is pretty high. According to this now relatively outdated information from 2015, the global head grade could be ranging between 0.8-0.9% at the moment, and global reserve grade below 0.5% even, so Kutcho’s average 2% grade is either way impressive. The by-products improve this to an excellent 2.92% copper equivalent grade:

Management has outlined plans to increase production, and has to increase Reserves for this. The main strategy for this is to use a lower cut-off grade in order to increase Reserves, and as indicated earlier is looking into upgrading Sumac by infill drilling. More on this later, let’s have a brief look at the 2017 PFS first.

The results of this study, more in particular the stellar after-tax IRR of 27.6%, was the reason I was fascinated straightaway when I heard about the acquisition. Usually a copper dominated project has a capex well over US$1B and has IRR’s below 20% @US$3.00/lb copper, but this one came in at a 53% higher IRR using US$2.75/lb copper as a base case, which is conservative at current copper prices of US$3.25/lb, and indicates healthy margins. A major threshold for me was also the capex of C$220.7M being lower than the after-tax NPV8 of C$265M, as I consider the capex being equal to NPV a solid starting point. As an aside: for megaprojects capex could be bigger to the tune of even 2 times before financiers/buyers lose interest, and IRR’s could sink to 14-15% in that case as well.

The PFS used a 2,500 tpd underground mining scenario with a starter pit, with a life of mine (LOM) of 12 years. This results in a C$88k capex/tpd ratio which seems fairly conservative as I will show in a minute. An interesting feature is the limiting of a tailings pond, which is beneficial to permitting this part, as relatively recent failures (2015: Mount Polley, Samarco) have increased scrutiny. The tailings will be sent to a paste backfill plant to produce a cemented paste, half of which will be used for backfill while the other half will be sent to the surface tailings disposal.

This sounds good, but as permitting in BC isn’t always easy, I still wondered why management opted for a small 1y starter pit, as open pits create more surface disturbance which generates more issues for permitting. According to management, the reason they retained the small year one open pit rather than having a 100% underground mine is that the hanging wall rocks from that pit are acid neutral or acid consuming and will be used as construction material for site roads and pads for infrastructure. They would have to dig a small pit for those materials anyway so the idea to have one dual purpose pit where they also get to extract ore from makes sense, at least to me.

Besides this, I suggested dry stack tailings as another option to minimize environmental impact and permitting risks. According to management, dry stack tailings versus paste tailings and a cover over them is something the company and JDS, the engineering firm responsible for the PFS, will indeed study in detail in the upcoming FS. However, at the moment the engineers at JDS favour the paste tailing facility due to factors surrounding climate and precipitation levels. If this remains the safest way to store the surface tailings, the company will be responsible for all interested parties, communities and First Nations understanding that.

CEO Sorace is very aware of the importance of including First Nations in the environmental process, and already struck a Communications Agreement with the Tahltan Central Government on October 26, 2017, creating the framework for strong engagement. Management has also taken initial steps to establish a relationship with the Kaska Dena Government. Typically an Impact Benefit Agreement is signed closer to the completion of a Feasibility or further along the process.

It is refreshing to see the First Nations having a prominent place early on in the process, and by hiring an expert like Alison Rippin Armstrong things seem to be in very good hands.

After this little intermezzo, let’s continue with the PFS. Recoveries will be 84.7% for copper and 75.7% for zinc, which indicates an opportunity to optimize the metallurgy according to management. The average annual production will be 33M lbs copper and 46M lbs zinc. The pay back period will be 3.5 years after-tax.

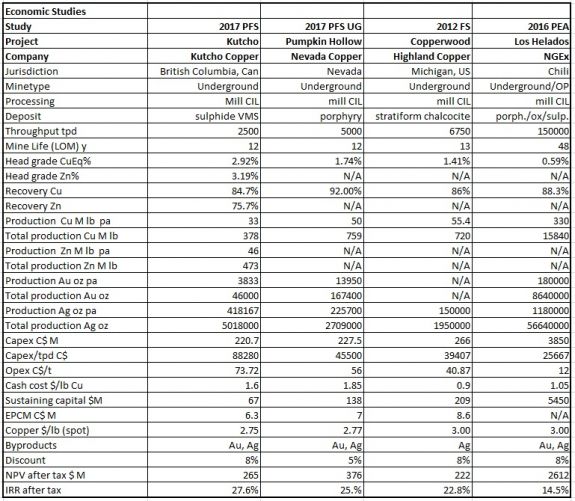

Although the company completed a PFS last year, and it isn’t easy to find comparable peers, I wanted to have some idea of metrics for underground copper projects:

As mentioned, it can be seen that capex for Kutcho seems low in absolute terms, but in relative terms it is at least twice as expensive compared to peers. This has a lot to do with infrastructure, but probably also with economies of scale, as you can see at the different throughput rates. I also included the monster project of NGex Resources, Los Helados, to show what scale can ultimately do for capex/tpd. This is one of the reasons that management is aiming at a 4,500tpd scenario. Sustaining capital seems low as well vs capex, compared to its US peers, especially for an underground operation. Management had this to say about it: it all depends how companies have distributed initial capex vs sustaining capex. The Kutcho initial capex includes items like full plant construction, road and full 1 year of underground development, therefore sustaining capital is low and primarily consists of underground development. I guess I would have to compare the studies more in-depth to fully understand the differences here.

The Nevada Copper IRR seems to look good on a conservative US$2.77/lb copper price, but looks can be somewhat deceiving. In reality their project has already benefitted from a huge US$220M in sunk costs. A significant part of it has been used for drilling, engineering, studies, permits etc, and also construction of part of the open pit component, but my guess is 35-50% was used for the underground project, more specific for engineering, surface infrastructure and facilities, headframe/hoist installation, warehouse, a 630m deep and 8m diameter production shaft and over 200m of lateral underground development.

Compared to the relatively high capex, Kutcho EPCM seemed low at first sight, but when I looked at Nevada Copper and Highland Copper, it turned out to be quite average for such North American relatively small scale copper operations. As can be seen, copper recoveries for Kutcho are below those of its peers, and this is another target of management, especially zinc recoveries, which shouldn’t be too hard to get to 80% in my view.

When discussing the project, a number of options for further improvement of economics have been identified. Here is a brief overview, and other options as well:

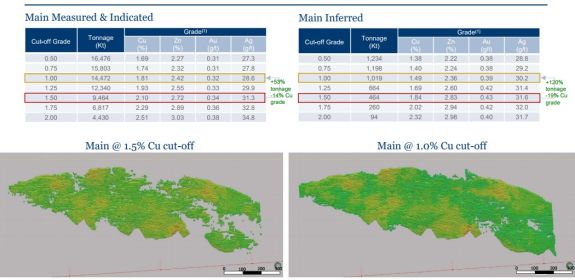

1. lowering the cut-off from 1.5% to 1% for the Main zone:

This could add 5Mt to the mine plan pretty easily, still maintaining most of the average grades for the various metals, and even more important the orebody looks much more continuous which could prevent dilution of ore with waste, so it wouldn’t surprise me if the actual head grade would be relatively higher versus the reserve grade in that case.

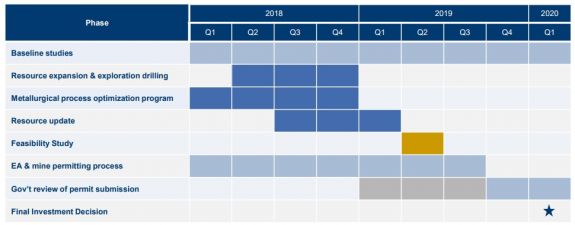

2. The same goes for Sumac, as this would add 4Mt. As Sumac is Inferred, more infill drilling is needed to convert this into Measured and Indicated and eventually into Reserves, needed for the upcoming Feasibility Study. The FS is planned for Q2 2019, as can be seen here:

3. The 3 deposits are all open down dip, so there is another possibility to add resources. According to management, 1.3-3.6Mt isn’t unrealistic at all. So Kutcho could be looking at 23-24Mt total tonnage potential.

4. There are many other drill targets identified on the property, more specific VMS sulphide horizons like the ones hosting the Kutcho deposits. To gain useful mineralization from these targets on a short term looks a bit like a long shot, as historic drill results were low grade, short intercepts which indicates lots of newly required drilling, but more importantly there is no time to possibly convert these targets from greenfield to eventual reserves before the end of Q4, 2018, when all drilling must be finished according to plan.

5. Improving recovery rates for copper and especially zinc, as according to the PFS: “Recoveries and reagent usage may be improved by further metallurgical test work, particularly zinc, which was not optimized during the latest round of metallurgical testing”.

6. The exchange rate of the Canadian Dollar versus the US Dollar is improving (PFS rate was 1.33, now 1.25)

7. Metal prices are significantly higher at the moment compared to the period when the PFS was completed (summer of 2017), management could hold on to these PFS price decks in order to be conservative, but in case of copper it doesn’t seem to be a long term risk to use a slightly higher price. For zinc it looks like the current US$1.10/lb is just fine for the long term.

8. When the current Reserve would go from 10,44Mt to an estimated 20Mt (as you have to take into account some dilution) if everything works out as intended, the possibility for a 4,500tpd operation becomes a reality. When using a bit lower capex/tpd figure because of economies of scale (down from C$88,280 to C$75,000), initial capex is estimated at C$337.5M (coming from C$220.7M). Lowering opex from C$73.72 to C$65 seems realistic too.

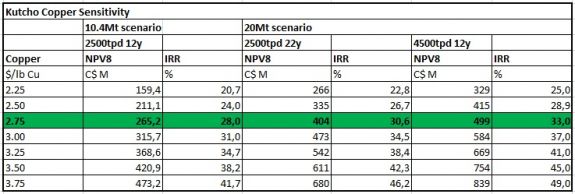

When I would use a 20Mt scenario, an 80% Zn recovery rate, a 1.25 exchange rate, a US$3.00 base case copper price and a fixed US$1.10 Zn price, a 2,500tpd throughput scenario for a LOM of 22 years, and a 4,500tpd throughput scenario for a LOM of 12 years, this would be the resulting hypothetical sensitivity table:

Although the average grade goes down a bit on the expansion scenarios, the advantage of adding tonnage is obvious. The 4,500tpd 12 year scenario avoids the increasing discount over the years as is the case with the 2,500tpd 22 year scenario, and would result in a higher NPV and slightly better IRR. The ideal scenario would be, in my view at least, developing the 4,500tpd scenario, followed by potential delineation of more reserves for a longer LOM through exploration, as the geologists have identified many VMS targets in the area:

COO and geologist Rob Duncan explained to me why the not-too-interestingly looking drill results provide enough material to see exploration potential. According to him, in VMS systems, the most important thing to understand is the volcanic stratigraphy (layering) and the position of the geological time breaks where massive sulphides (from black smoker chimneys etc.) can accumulate on the sea floor or in the near subsurface.

The exploration results, simply because numerous assays do contain mineralization, however in short intercepts, indicate that the correct position has been found and that the semi massive or massive sulphides found there do contain economic metal minerals. In other words they are not completely barren.

None of those results are near economic, however, Duncan has seen several examples where economic intersections can occur only 50m along strike from results like these. This is possible due to how dynamic the volcanic environment was at the time of formation. Just 50m away a different volcanic unit could very well provide the boundary for a sub basin that thicker accumulations if sulphides can get trapped in. Another frequent case is that in combination with the above, a secondary structure could appear, along which new volcanic units erupt from and/or higher heat flow channels the mineralized fluids through. So far drilling has resulted in economic grades, assumed to be in the vicinity of hopefully something bigger, by only the current anomalous results.

According to the opinion of Duncan, none of the exploration intersections (other than immediately west of Esso) represent targets from which to build resources from for now, but are highly encouraging from a pure exploration discovery point of view. Looking at the anomalous, non-economic results, versus the advanced stage of the existing deposits, I can only agree with this as it is too early stage to be included in the upcoming FS. However, this exploration potential could prove to be very interesting later on, as all intercepts are located within a 10km radius from the Main deposit, providing for good trucking options if economic mineralization might be discovered.

If this is the case, and tonnage could be added in order to increase LOM, this will have an impact on NPV and probably valuation as well in the future. In order to get an idea about valuation of Kutcho Copper, I will discuss this subject in the next paragraph.

6. Valuation

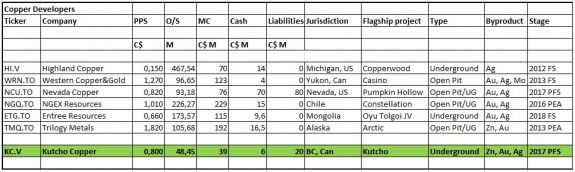

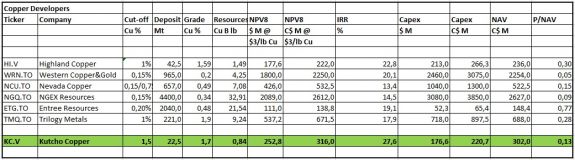

As I usually do, a peer comparison often comes in handy when it’s about time to say something about valuations. Not so this time, as my tables just indicate that for copper projects there is incredible variation in typical metrics, notwithstanding stage or jurisdiction:

And:

As is always the case with peer comparisons, every company has its own story with very specific details, causing valuations the way they are, therefore making it impossible to take comparison results at face value. A few remarks: for Nevada Copper I used the combined PFS this time, indicating economics for the total project, which are less positive than just the earlier mentioned underground scenario. This causes Nevada Copper to trade more or less as a leveraged play on copper, especially with a capex still much higher than NPV. Western Copper&Gold applied fairly high metal prices besides copper, for example US$1400/oz for gold which is 35-40% of revenues. A somewhat more industry-standard US$1250/oz would have taken down the IRR to about 19%. Additional issue here is a big capex, also 37% larger than NPV. Besides this, because it is a large open pit operation and permitting in the Yukon isn’t easy, the permitting takes a long time.

Although it isn’t a bad project, this causes the P/NAV to be very low, actually the lowest in my table. Entree is actually a very different situation, with the Oyu Tolgoi 20% JV, where it is taken to production by Rio Tinto. I just included it to more or less show the valuation of a developer under construction. As Entree has more projects at Oyu Tolgoi, and the recently published PEA results include them all, my figures aren’t very straightforward, but I chose to use the most advanced, smaller part.

Maybe the best peer to look at is Highland Copper, although this one also has another, earlier stage project (White Pine) besides its flagship project Copperwood. It has been sitting on a 2012 FS for a very long time, actually during the full bear market, and will come with an updated FS in Q2, 2018. The grade, size and economics of their Copperwood project are more or less comparable, and Michigan, US is a solid mining jurisdiction. It appears that Highland already has all major permits in place. The company has top notch shareholders (Greenstone 17%, Osisko Royalties 15%, Orion Mine Finance 14% and also 24% Institutional shareholders), and management and directors hold 7% as well, which is all pretty impressive. There are a few differences of course: the share structure is very much diluted with 467.5M O/S and 617.8M F/D, and I am not aware of any financial packages like Kutcho Copper has arranged. Notwithstanding this, I consider Highland Copper an interesting copper play, worth further due diligence, as I don’t own it yet. This all results in a P/NAV for Highland of 0.30, which is 130% higher compared to the current figure for Kutcho Copper, which indicates re-rating potential.

When we would look at the P/NAV of smaller producers like Nevsun, Sierra Metals and others, we see an average P/NAV of 0.6-0.7, and considering the size of the Kutcho deposits so far, this category is the direction Kutcho Copper will be going.

It is very hard to pinpoint towards a value of a developer before it is fully financed and ideally built and commencing production, but in my view the Highland Copper P/NAV of 0.3 provides us with a realistic and conservative guidance at FS/permitted stage. With the current base case NPV8 of C$265M @US$2.75/lb Cu, this would result in an estimated market cap of C$79.5M, and a hypothetical F/D share price of C$1.14. As management isn’t going to sit on their hands, assuming they can in fact prove up 20Mt in Reserves, the 4,500tpd scenario would generate an estimated NPV8 @US$3.00 of C$584M, which would result in a hypothetical F/D share price of C$2.50 in 2 years from now, if all goes as planned. Also keep in mind that the Kutcho economics are excellent for a base metal project, and excellent economics usually get a premium in the market.

When the company achieves capex financing and successful construction afterwards, the P/NAV of 0.6-0.7 comes on the radar, with hypothetical targets of C$4 in sight, including new dilution as any package would probably contain some new equity. And this is all still at C$3.00/lb copper and C$1.10/lb zinc, which could prove to be conservative in a few years from now.

For this year, all efforts are geared towards increasing and upgrading the reserves/resources by lots of drilling, optimizing metallurgy, doing baseline studies and environmental assessment/permitting work. This will result in two major catalysts in the first half of next year: the updated resource estimate in Q1 2019, and the FS in Q2 2019. I asked management if they would be open to provide an updated PFS somewhere halfway (Q3 2018), based on already converted resources and optimizations until that point, and it seems a possibility in order to avoid a 2 year timeframe between the PFS and FS.

7. Conclusion

The longer I look at Kutcho Copper, the more I realize this is a very rare junior. It isn’t ten-bagger material in 2 years, but in my view this could be one of the most compelling and low risk triples over that same time frame that I know of.

Management is top notch, the project has excellent economics and lots of upside potential, backers are top quality with Wheaton Precious Metals, and main metal copper is forecasted to go into long term deficits, which could create higher metal prices. Dilution will be limited to an absolute minimum as everything up to the start of construction barring unexpected events is accounted for financially, and the share structure is already very tight.

All fundamentals appear to check out for this junior, and it seems only a matter of time before Kutcho Copper enjoys even further enhanced project economics, visualized by key catalysts, hopefully causing a significant re-rating. In my view, Kutcho Copper could very well be on its way to establish itself as one of the go-to base metal juniors of 2018 and beyond.

Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Kutcho Copper is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kutcho.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.