Critical Investor, released on May 22, 2018

1. Introduction

After entering the markets with a big splash in December 2017, on the back of an almost monumental deal (for a nano cap) with Wheaton Precious Metals, Kutcho Copper (KC.V) has been working quietly but diligently behind the scenes, to set up everything for further development of their high grade copper-zinc Kutcho project in British Columbia.

Their goal is to advance the deposit to ultimately double the current size, and by doing this improve current 2017 Pre Feasibility Study (PFS) economics when the Feasibility Study (FS) will be completed a year from now. In this article I will discuss proceedings for this year, revisit economic potential and valuations, and will have a more in-depth look in the WPM stream, in order to show it is in fact a good deal for Kutcho Copper compared to others.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. Current status and plans

Before I continue with current activities, let’s have a look at a few basics first. Kutcho Copper has $4.5M in cash at the moment after receiving the first US$3.5M payment from WPM on April 4, 2018, and C$20M in debt. The second payment of US$3.5M is expected in August of this year. As a reminder, management and Board controls 10% of shares which counts as above average skin in the game. Wheaton Precious Metals holds 13% and Capstone Mining is the largest shareholder with 16%.

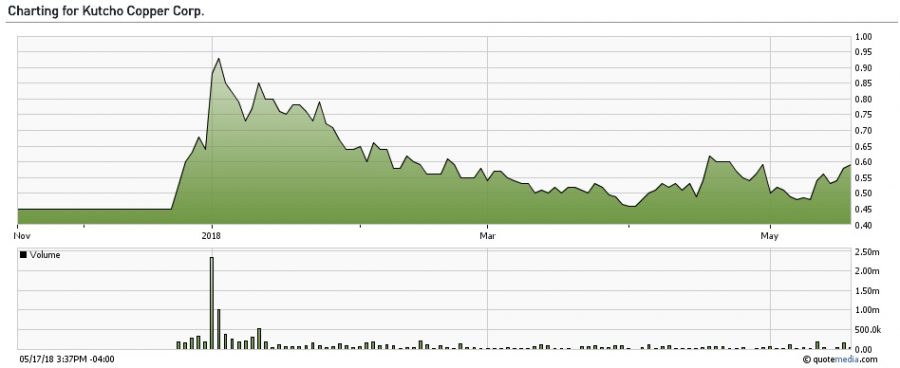

As of May 18, Kutcho Copper has a share price of C$0.59 and a market cap of C$28.18M, with only a very tight 47.77M shares outstanding (fully diluted 70.1M, all options and warrants out of the money at C$1.00, expiry in 3 years). The average daily volume of last month is 43k shares, which is about 10% of the average of the first 2 months.

Share price over 1 year period

After the big entry in December, the stock gradually went down lower as everybody that was interested took a position in these first months, and buying pressure and volume decreased. When looking at the chart it seemed that the C$0.45-50 level functions as a solid bottom and an indicator of minimum fundamental value the market was willing to pay for Kutcho, as there were no strong catalysts or marketing since Dec 2017-Jan 2018. As the summer drill program is about to start and further catalysts are expected, I expect investor awareness for this company improving again, facilitating a second wave of new entrants.

As a reminder, Kutcho Copper management has planned the scale of the upcoming field program such that they can achieve all the technical data collection for the feasibility in one field season. The easy field season up there is May 21 to October 31. Outside this window, things are not impossible, just more expensive, and therefore the company is looking to complete all drilling requirements within this period.

All kinds of equipment, supporting the upcoming field program, is being transported to location at the moment. Camp construction and commissioning is anticipated to be completed by June 1st, and drilling with two rigs will commence on June 15th. According to COO Duncan, if needed the number of rigs will be scaled up to four in order to finish before the winter break. The 2018 field program will look to expand resources through infill drilling for inclusion in the FS, and to provide data for the optimization of metallurgical recoveries and geotechnical parameters.

Under the engineering lead of Ausenco, the recently hired engineering firm to do the FS, the team consists of: Sim Geological Inc. for resource modeling, Holland & Holland for metallurgical engineering and process design, Terrane Geoscience Inc. for geotechnical engineering, and SRK Consulting for open pit and underground mine design among others.

I am not too familiar with the other names, but Ausenco is a worldwide operating firm, worked for majors like BHP, Glencore, Newmont, Vale and numerous others like copper/base metal focused Hudbay, Las Bambas, Teck, and also did a good job at Atlantic Gold’s Moose River project. I am happy to see SRK, which I regard as one of the top two or three in the mining business, doing the mine design. This will probably generate a lot of confidence in the quality of this study and its economics.

Exploration camp used by Kutcho Copper

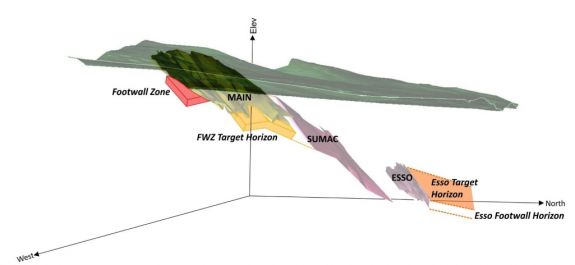

Although the upcoming drill program will focus on infill drilling, several priority drill ready targets prospective for additional resources have also been prepared. These prospective targets include, as mentioned in the corresponding news release:

– Mineralized drill intersections along strike and down plunge to the west from the Esso deposit (one of three VMS deposits comprising the Kutcho project) including 7.1 metres @ 1.96% copper, 5.24% zinc, and 18.0 g/t silver in DDH 94-B3. These intercepts could represent extensions to the high-grade Esso deposit or a potential new deposit.

– The FWZ, a relatively narrow sulphide lens (2 to 5 metres thick) which lies beneath the Main zone and which was subject to an historic estimate prepared as an internal document for Esso Minerals in 1979, of 230,000 tonnes averaging 1.47% copper, 5.52% zinc, 0.4 g/t gold and 43.7 g/t silver. The FWZ may have potential along strike and down dip for additional mineral resources. This mineralized zone demonstrates that additional horizons across the property are productive for VMS style mineralization:

– Main mineralization is open down-dip along 800 m, or 57%, of the total strike for this deposit, indicating potential for resource expansion down-dip.

– Esso mineralization is open down-dip along 300 m, or 50%, of the total strike for this deposit, and is open up-dip along 125 m or 20% of the total strike, indicating potential for resource expansion both up- and down-dip.

– Favourable untested stratigraphy east of the Main Zone, and on the southern portion of the property where the Kutcho time equivalent sulphide horizon is repeated by folding.

After asking management about the timeline of these targets, it seems that none of them will be explored this year: “Esso and Esso West are deep targets, so unlikely to get to them this summer (more likely to be targeted once underground). Also, the FWZ and Main down-dip targets would be higher priority than the repeated sulphide horizons on the southern portion of the property, as targets proximal to and along trend with mineralized lenses tend to provide a higher probability of finding more of the same.”

Working with the First Nations is also a priority for management, and in addition to reaching a Communications Agreement with the Tahltan Central Government on October 26, 2017, the company also signed an Exploration Agreement on April 17, 2018. As the Kutcho project is also located on land involving the Kaska First Nations, the company is engaging them too. The Kaska FN relationship is progressing and management is working towards completing of the agreements at the moment.

I like to see the First Nations having a prominent place early on in the process, this is addressing potential risks at the right time. With a well-known expert like Alison Rippin Armstrong things seem to be in very good hands. She has also re-initiated baseline studies for environmental assessments on February 14, 2018.

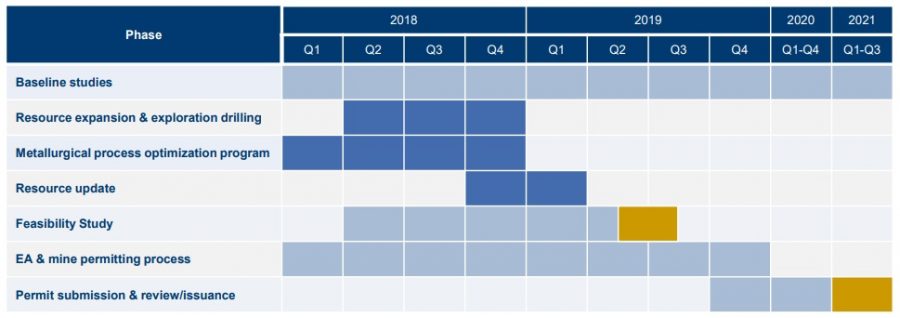

The current timeline for the Kutcho project looks like this:

As can be seen when comparing the timelines in my last analysis, the FS, permitting and construction decision has been moved into the future. The FS moved a half quarter, the permitting a quarter and the permit review over one year. The guidance was 30 to 36 months, and has now been extended to 41 months. According to COO Rob Duncan, the Federal and Provincial governments are re-vitalizing their permitting processes to increase the importance of social aspects of resource projects to better their efforts with respect to their duty to Consult with First Nations on a government to government basis. The results of these changes should be greater surety earlier on in the permitting life of projects in successfully receiving all permits required to mine. While updates to the permitting process have not yet been officially rolled out, Kutcho Copper has adjusted its project timeline, in part to incorporate the anticipated changes, and also as a result of extensive interaction with government offices which provide guidance on permitting timelines using the Kemess and Brucejack underground mines as real world examples.

3. Stream Comparison

In my last analysis I mentioned that Kutcho Copper closed a stream deal with WPM on industry standard terms, illustrated by an example of the ongoing cash payments for silver coming in at 20% at the Glencore-Wheaton deal (US$900M upfront cash). Since then I read some comments on ceo.ca about the Kutcho/WPM stream basically being expensive and at the expense of Kutcho economics, and although I already knew by asking experts that this wasn’t the case, I decided to look a bit further into this.

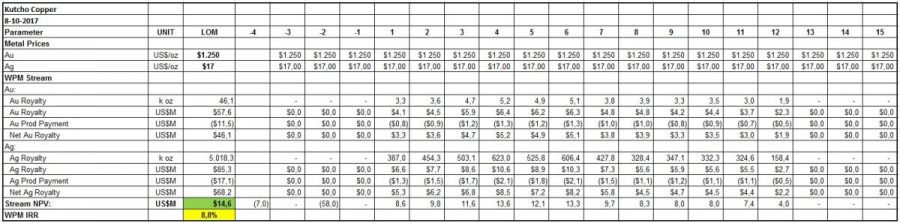

A way to look at the profitability of streams, as indicated in those comments on ceo.ca, and a much more comprehensive way compared to cash payment percentages, is to analyze the Internal Rate of Return (IRR) for the stream owner. In order to compare the profitability of the Kutcho stream, I analyzed several other streams for IRR, after normalizing metal prices for all streams (gold US$1250/oz, silver US$17/oz). Here we go, first up is the Kutcho/WPM stream, both NPV and IRR for all cases presented are pre-tax as taxes on these streams can be complex and isn’t needed to illustrate the comparison:

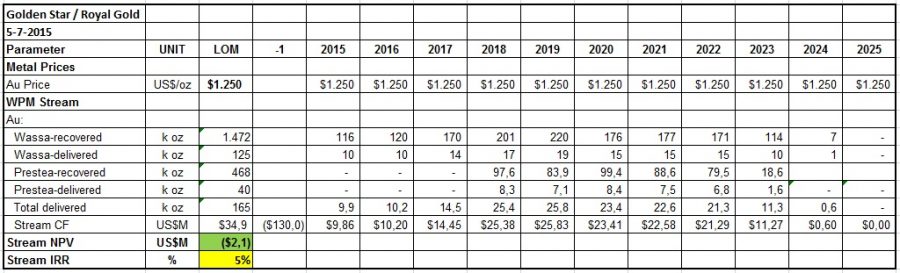

Then we have the Golden Star/Royal Gold stream:

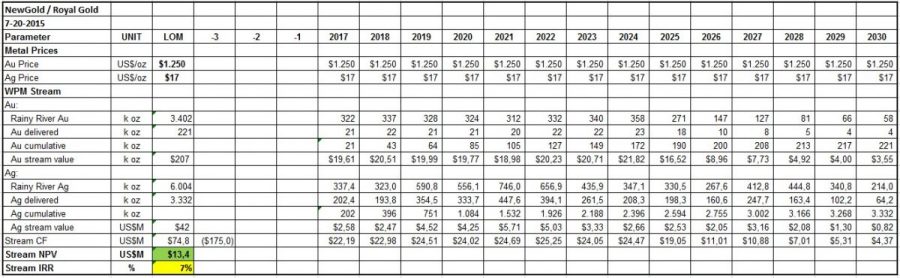

And the NewGold/Royal Gold stream:

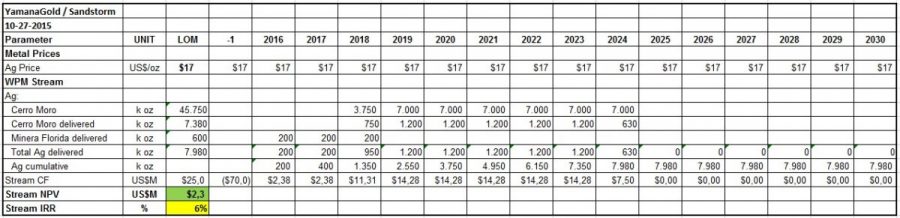

Followed by the Yamana/Sandstorm stream:

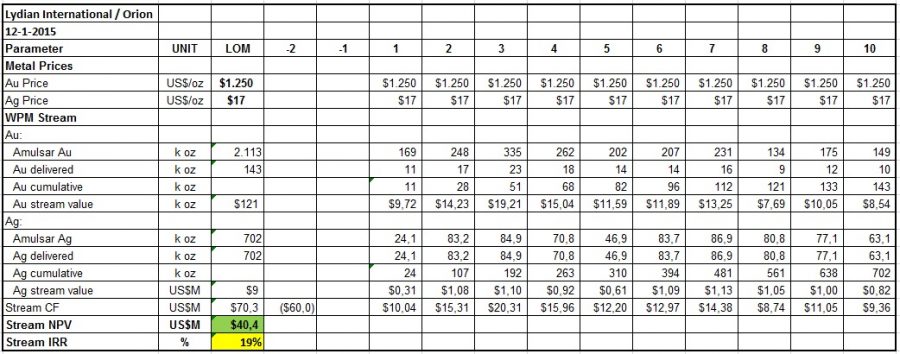

And the Lydian/Orion stream:

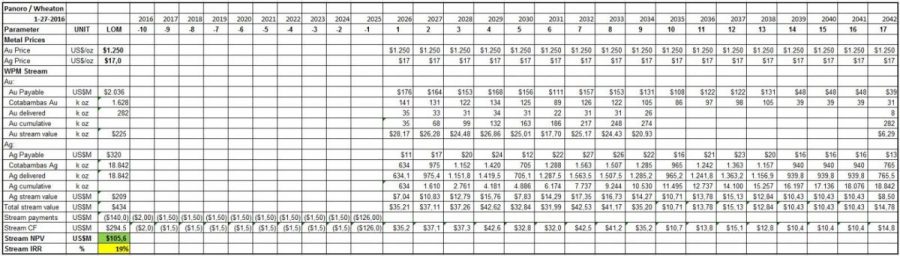

Next up is the Panoro/WPM stream:

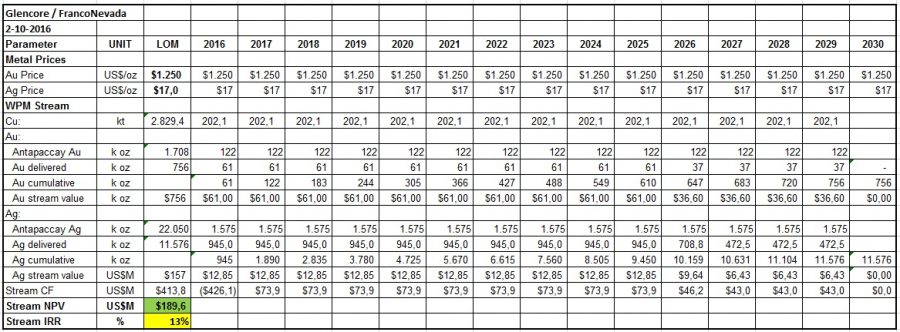

And the Glencore/Franco Nevada stream:

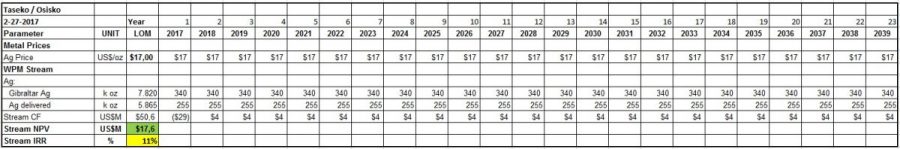

And last but not least the Taseko/Osisko stream:

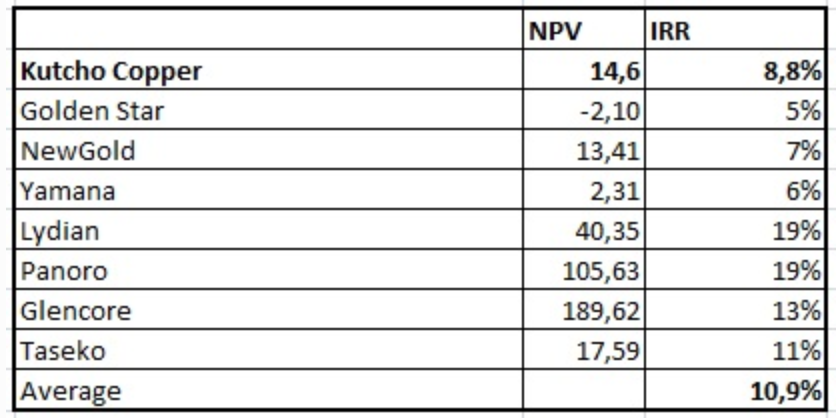

When I put all NPV’s and IRR’s in one table, it looks like this:

As can be concluded, Kutcho Copper/WPM doesn’t have the lowest IRR on its stream of all peers, but it is below average, and certainly in line with or below comparable streams regarding pre-tax NPV. The IRR seems a direct indicator for risk on the project, for example Lydian has a jurisdictional risk, and Panoro a financing risk (and according to an influential blogger also a local risk but I don’t know the details on this), as it needs a pretty high copper price (US$3.25/lb Cu for a post-tax IRR of 19.5%) in order to be economic (I estimate post-tax IRR of 18% as a threshold for this mid sized project).

4. Copper revisited

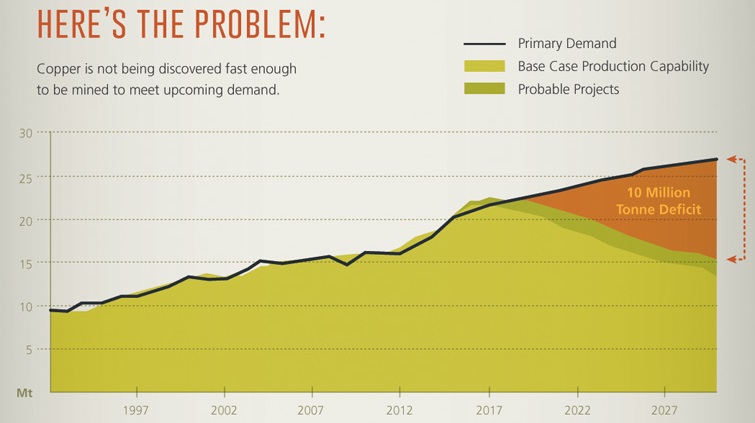

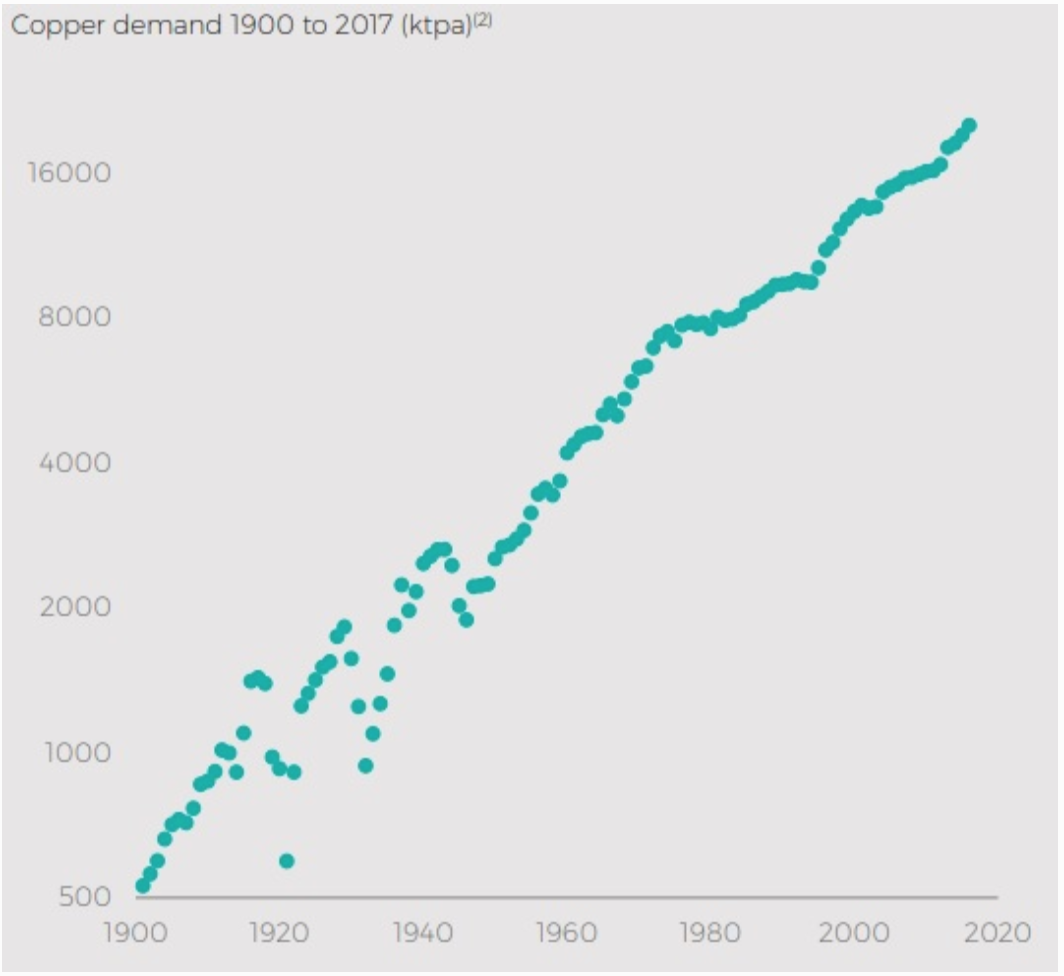

Talking about copper, let’s have a quick look at the latest outlooks on the red metal by 4 of the biggest producers/traders in the world. The usual chart (for example Rio Tinto has used the same chart for years) describing copper supply/demand looks more or less like this, as illustrated nicely by the Visual Capitalist:

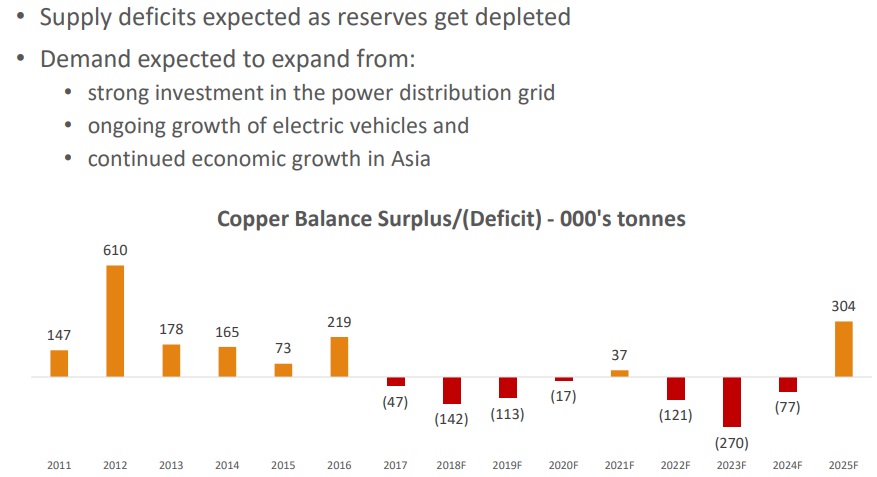

First Quantum Minerals has the following view on supply/demand developments:

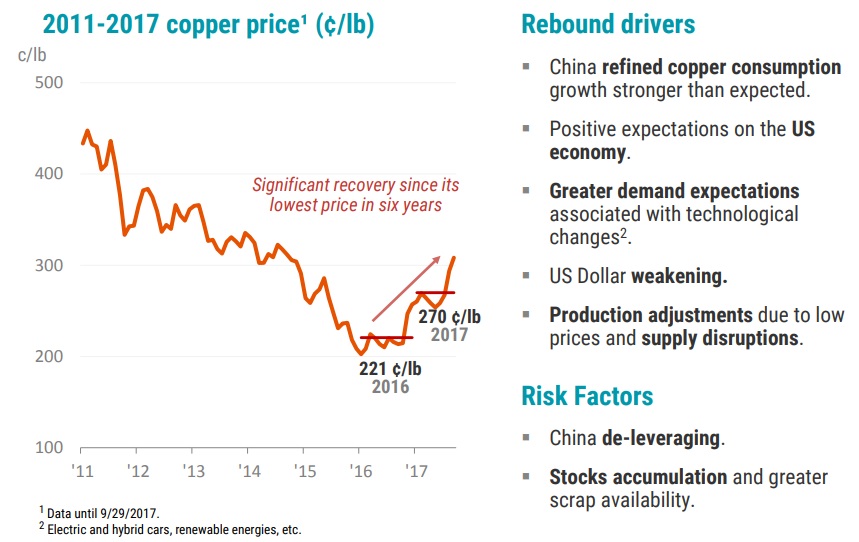

Personally I find the surplus in 2021 remarkable, as we are supposed to be deep into a deficit by then. Codelco, the Chilean state-owned giant and largest copper producer in the world, has this view:

Freeport McMoran has the following outlook for copper, but doesn’t provide a forecast on demand or pricing, just like Codelco:

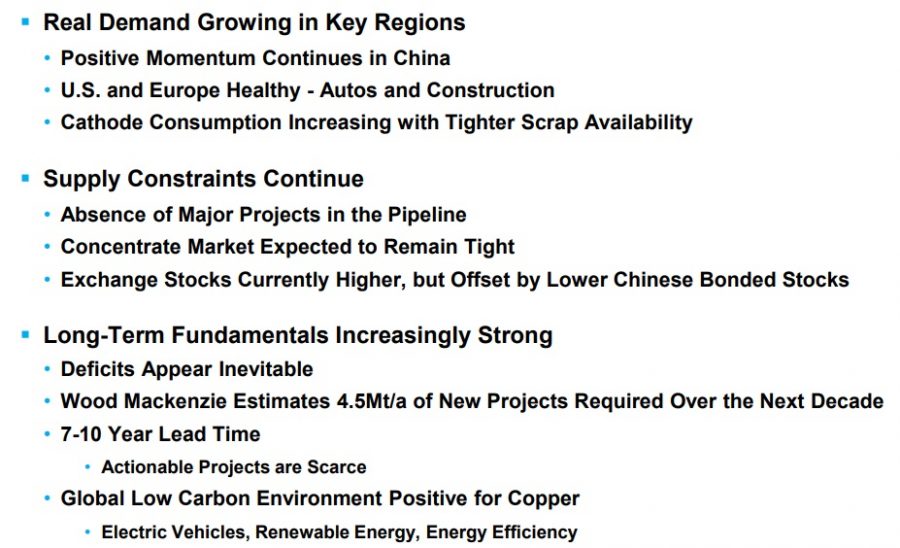

Glencore, a combined producer/largest trading house on the other hand foresees a consistent increase for copper demand, and has an interesting story to tell in their presentation about over-investment in the years before 2016, and makes statements about the influence of the increasing electrification of our society on metal demand, an interesting read. This is their view on demand for the next few years:

However they avoid to come up with a comparable outlook for global supply. I do agree with the central thesis of new and sufficiently large deposits not being discovered fast enough, capex at very low levels and very few new projects in the pipeline, and fancy the long term outlook on copper a lot.

5. Potential Economics & Valuation Revisited

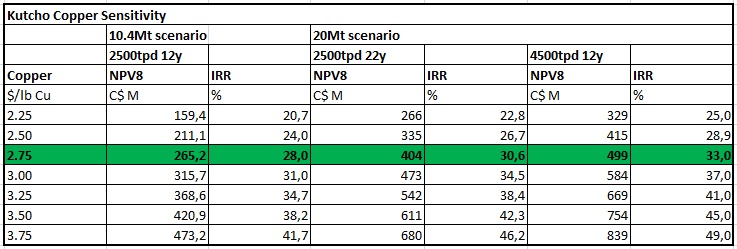

As a reminder, the base case scenario of the 2017 PFS generates an after-tax NPV8 (8% discount) of C$265M and an after-tax IRR of 27.6%, using metal prices of US$2.75/lb copper, US$1.10/lb zinc, US$17.00/oz silver and US$1,250/oz gold and a currency exchange rate of 0.75 USD/CAD. This is all based on a modest initial capex of C$220.7M which is well below base case NPV8, which is a strong feat for a base metal project in general. Especially the larger projects have a capex often outscoring NPV8 by 20-50%.

Although the Kutcho project already has a much higher NPV8 compared to the current market cap (C$265M vs C$28.18M), there is clear appeal in doubling the resource and improving economics. There are several ways like lowering the cut-off from 1.5% to 1% for the Main zone (which could add up to 5Mt to the mine plan), convert Inferred to M&I or later on to Reserves for the Sumac Zone, as this would add about 4Mt, and add tonnage through drilling at depth, which could add another 1.3-3.6Mt. This could definitely generate tonnage in the realm of 20Mt. Other opportunities are improving recoveries of copper and zinc, FX rates, higher metal prices and further optimization of for example mine plan and opex. On the longer term there is a lot of exploration potential, and even further out there is potential for new discoveries at the newly optioned TCS property not too far away.

All opportunities considered, and as a reminder, when I would use a 20Mt scenario, an 80% Zn recovery rate, a 1.25 exchange rate, a US$2.75 base case copper price and a fixed US$1.10 Zn price, a 2,500tpd throughput scenario for a LOM of 22 years, and a 4,500tpd throughput scenario for a LOM of 12 years, this would be the resulting, familiar, hypothetical sensitivity table:

By running the numbers it shows why developing the 4,500tpd scenario probably is the most economic scenario, followed by potential delineation of more resources (and eventually into reserves) for a longer LOM through exploration.

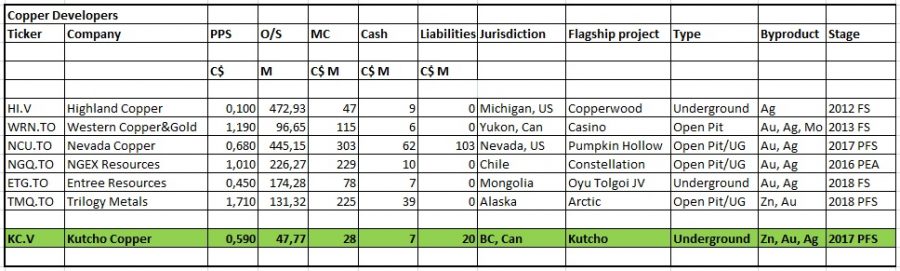

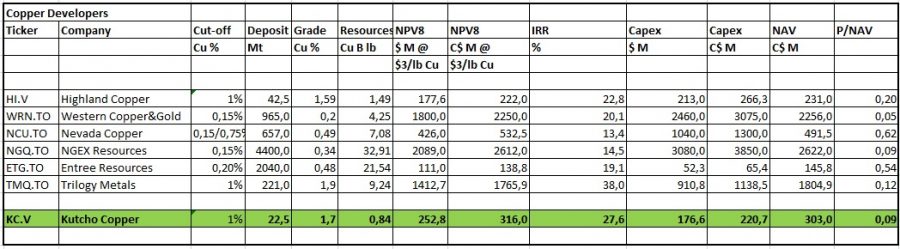

I updated the peer comparison, despite incredible variation in typical metrics, notwithstanding stage or jurisdiction, at least it represents a brief overview of copper projects:

and:

As a rule of thumb and always the case with peer comparisons, every company has its own story with very specific details, causing valuations the way they are, therefore making it impossible to take comparison results at face value. Without going too deep into different peers, I must say I was pretty impressed with the recent PFS delivered by Rick van Nieuwenhuyses Trilogy Metals, their post-tax IRR of 38% is unheard of for a copper project. As it is very nordic they really needed something special, and it very much looks like they succeeded. A P/NAV of 0.12 is almost ridiculous in my opinion, and keep in mind they have two projects. It is on top of my watchlist.

Again, it is very hard to pinpoint towards a value of a developer before it is fully financed and ideally built and commencing production, as there isn’t particularly strong comparison material to work with, but in my view the Highland Copper P/NAV of 0.2 (down from 0.3 in my last analysis as the share price of Highland lost 1/3 the last month by big selling out of the blue) provides us with a realistic and conservative guidance at FS/permitted stage. With the current base case NPV8 of C$265M @US$2.75/lb Cu, this could roughly result in a potential double for Kutcho arriving at the same stage, and when using the 20Mt scenario in a potential triple or more.

6. Conclusion

After a winter of preparations, Kutcho Copper has finally arrived at the start of their field program, and will start drilling in about a month from now. Doubling the resource in Q1 2019 seems to be a very realistic target, and if this milestone is achieved, economics will improve even more, with the NPV increasing quite significantly. In mining, usually nothing goes smoothly, but in this rare case I expect Kutcho Copper to sail pretty effortlessly to a potential double in a bit over a year from now, when the FS comes out.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Kutcho Copper is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kutcho.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.