Chuck Downey:

Hi Matt, great to meet you and great to do this interview. My name’s Chuck Downey. I’m the president and CEO of Eagle Plains Resources, actually recently appointed president CEO of Eagle Plains Resources. We’re based in southeastern British Columbia. We are a project generator, so we use our business model to try to de-risk our projects. I’ve been in the exploration business for about 40 years now. I’ve worked mostly in Canada, but I’ve also worked overseas. I’ve worked for a couple of major companies as well. And I’ve been with Eagle Plains full time since 1999, so I’ve got a long history with the company and a long history with their projects.

Matthew Gordon:

Lovely to meet you, Chuck. Thanks for coming on the show. It’s kind of interesting on this one, there’s a lot going on: mineral exploration, project generation, corporate incubator, contractor and royalty holder. I’m not quite sure where to look. So talk me through the plan because there’s revenue in, there’s exploration in there. There’s a lot of moving parts. What should I be looking at first?

Chuck Downey:

I guess the first thing I would look at is Eagle Plains, I think I’d look at our history. So the company was started by Tim Termuende and his father Bob Termuende over 30 years ago. We’re the ninth oldest company that’s been listed on the Toronto Venture Exchange. We’ve never been rolled back. We’ve got a very healthy treasury, probably a lot of it’s due to our business model. Although I’m somewhat loath to use the word, I think we have a sustainable business model because we actually have a revenue stream, which not a lot of junior exploration companies do. So we don’t really have to go to the market very often for financing. So right now we’ve got a very healthy treasury. We’ve got about seven and a half million in cash. We’ve got another roughly $1.8 million in equities.

A lot of our business model involves us doing a lot of deals with junior companies who don’t have a lot of cash. So typically we involve a lot of shares in our deals and a lot of times the shares don’t really turn out to be worth very much, but every so often we have either a big upturn in the market, which the rising tide lifts all boats, or we have a specific shares in our portfolio that for whatever reason have gone up. So we can use that to sell the shares to actually create more equity in the company as well.

Matthew Gordon:

Okay, right. So I’m interested in this. So out at 30 years, market cap 15 million or thereabouts. So what’s in it for people? Do you do dividends or was it just the ability to spin-out shares, sell shares in other companies? Why should people be interested?

Chuck Downey:

I think for us, we sort look at it, there’s sort of four pillars of our company. We’re an exploration company, we’re also a project generator. We are also a geological contractor, and we’re a corporate incubator. And I’ll just maybe just touch briefly on a couple of those points. So for an exploration company, as I mentioned, I’ve been in the business for 40 years. My partner Tim has been in the business for roughly the same length of time. We met right after we both graduated from university. So we’ve got a lot of staying power. As I mentioned, the company’s been around for over 30 years. And we’re basically a company of geologists. So we’ve always prided ourselves on being ahead of the game in trying to identify areas that we should be exploring. Our business model, we’ve got a wide range of commodities in our portfolio.

So whatever is hot at the time, we’ve always got something in our portfolio. Usually it’s something that we’ve acquired some time ago, like for instance with the uranium that we’re going to talk a bit more about in depth. But with the uranium projects, we’ve been working in Saskatchewan for over 20 years now. When uranium was really in vogue, we were working in Saskatchewan. And we’ve also, over the last two or three years we’ve acquired a lot of copper projects in British Columbia. Everyone’s looking for copper projects. We’ve got a bunch of those in our portfolio as well. So that’s one of the pillars of our business is certainly the exploration company.

Within that, we’ve always got a couple of projects we consider to be flagship projects. We’re based in southeastern British Columbia near the historic Sullivan Mine. And when we first started, that was our main focus, was looking for sedex projects. And so we’ve got three high profile projects right now, two that are under option. They’re all a hundred percent owned by Eagle Plains, but one of them is a hundred percent operated by Eagle Plains.

And these projects, we’ve been working on them for probably over 20 to 25 years and they’ve all got earmarks of having Sullivan type mineralization on them. They’ve got Sullivan smoke, they’ve got the right geological setting. One of them is the Vulcan project, which is our flagship project in Eagle Plains. And I guess over the last three years we’ve spent about 3 million of our own money exploring the project and it looks like we’re on the edge of a sub basin, a mineralized sub basin. It’s got really good alteration. Every hole we’ve drilled, we’ve hit mineralization. And we’re just right now trying to vector in on where the sweet spot is in that. And obviously this would be a massive find. The Sullivan ran for over a hundred years, basically built the communities of Kimberly and Trail. So that would be a fantastic find for us as a company.

Matthew Gordon:

Let’s come back to Vulcan. Let’s come back to that. I want to stick with the prospect… Okay, you’re a bunch of exploration geologists. So you do it for yourselves and you outsource that to other people. Is that right? I’m just going to work out the different revenue streams. Because those things, it’s tough. Especially after a period we’ve just been through, it’s really, really tough. It’s kind of like staying at the table, right? You’ve got to find a way to get through to when the markets come back again. So the exploration, just explain that. You do your own stuff, prospect generation stuff. And do you outsource that, your exploration skills as well?

Chuck Downey:

No, that’s one of the beauties of our business model. So yeah, we’re a project generator. This is a very risky business, so we’ve got, as I mentioned, a wide portfolio projects, wide range of commodities. We try to de-risk the exploration cycle by finding partners for these projects. Through our geological expertise, we identify areas we want to stake and acquire projects. We own all of our projects a hundred percent, we just about always acquire them through staking. We very rarely do deals with other companies like option deals or purchase deals. All of our projects pretty well are acquired through research and staking. We spend some upfront cash of our own on there to try to figure out if they’re worth holding onto and try to identify what is the salient points of those projects. If they look interesting, then we’ll write a technical report and then we’ll start looking for partners for them.

So we bring in a partner and we give them… We’ve done, I don’t know, probably a hundred deals since the company was started. And we basically, what we do is we give our partners a very easy path to get 60% ownership in the company by doing modest cash payments, exploration work. As I mentioned, we typically will take a lot of shares because a lot of the juniors don’t have much cash. So we’ll do the exploration work, cash, and give them an easy path to get 60%.

And then you were talking about the contracting out or where do we get the expertise from? Well, we’ve got an in-house company, TerraLogic Exploration, which is a wholly owned subsidiary of Eagle Plains. It’s got 10 or 12 employees, I guess about 12 full time right now based in Cranbrook. And we use that company to do the work on our projects. So they work for Eagle Plains, they work for our partners. But they also work for third parties. So a lot of the companies that we option, we do options with bigger companies that have their own exploration groups. And in that case, a lot of times the bigger partner will carry the workout. But we use TerraLogic to do the work on those projects. A lot of the juniors don’t have the technical expertise, so we can supply that as part of the package.

Matthew Gordon:

So TerraLogic, who owns it? Who owns that company?

Chuck Downey:

Eagle Plains, wholly owned subsidiary.

Matthew Gordon:

Eagle Plains owns it. Okay. So revenue comes in against whatever it is that those guys do, and that kind of money is also used to fund your own activities. Okay, understood. Can we just go through a couple of case studies here then, because I want to understand what’s in it for me, right? I read somewhere you’ve just had over a hundred million bucks worth of dividends. That’s good. Okay, that’s good. And you described it earlier, you have projects out and option agreements with other parties. So let’s take a look at one that you’ve done and what the economics look like in that. Use whatever one you want. And then second, let’s kind of go over to uranium just to sort of understand because it’s a pretty hot market at the moment, uranium. I’d love to understand what you’d be looking for in that instance. So whatever gold, lithium, copper, whichever project case study you can give me in terms of how you monetized it for your shareholders. Sure.

Chuck Downey:

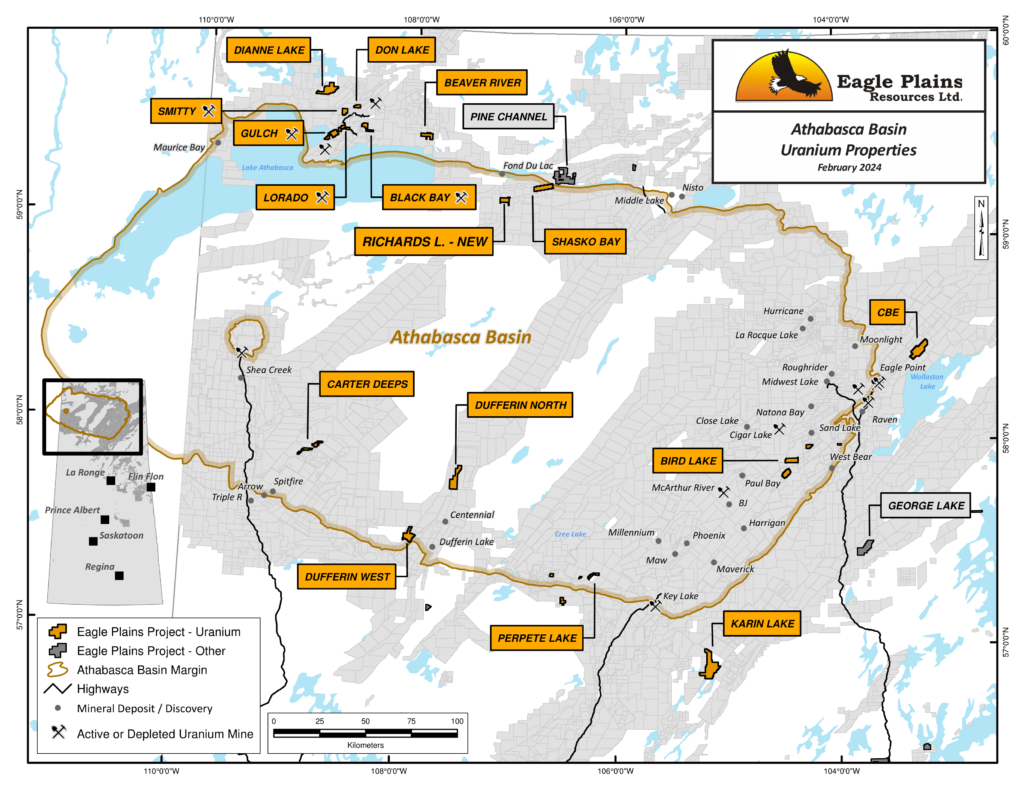

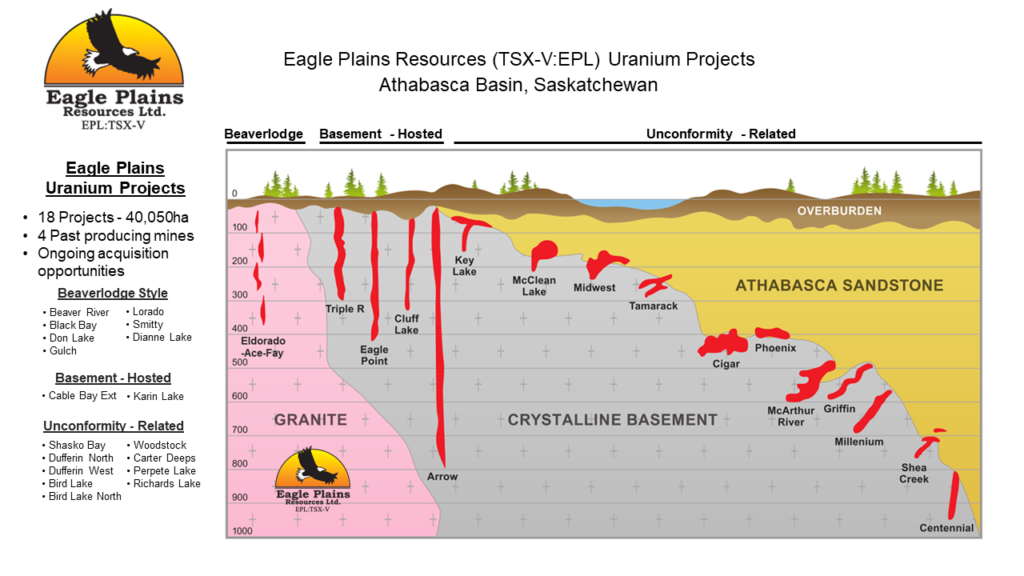

Sure. So right now, and as I mentioned, a big part of our business model to find partners. So right now we’ve got seven active option agreements that cover I think 17 projects. We’ve recently signed an agreement with a company Xcite. And they’re a junior and they’re interested in getting into the uranium space in Saskatchewan. We’ve been very active staking in Saskatchewan. Well, like I mentioned, we’ve been there for 20 years. But I’d say the last year, year and a half, the space has really started to heat up. And because of the way the tenure system works in Saskatchewan, there’s been a lot of high quality projects that have been open for staking just because of the way the tenure system works basically. So we’ve been able to acquire some fantastic assets. And among those assets, we acquired six projects right around Uranium City, which is actually the first place that uranium was produced in Canada was around Uranium City in northern Saskatchewan. It’s Beaverlodge type deposits. They’re narrow veins, but very, very high grade.

So we’ve acquired six projects around there and we recently did a deal with Xcite. So it’s a very good-looking deal. We’ve put six projects into there and they can earn an 80% interest in those projects by doing about 19.2 million in work four and issuing four and a half million shares and just over $300,000 in cash. And the projects look really, really good. Unlike a lot of the places where people are exploring in Saskatchewan, there’s no ground cover around the Beaverlodge, Uranium City area. So all the mineralization is basically exposed on surface. Three of the projects have got historic past production on them, and the area hasn’t really seen any sustained work since the 1980s.

So it’s an area that’s kind of laid dormant. And as I said, now that the claims are starting to open up, more companies are up there as well as Eagle Plains working up there with this deal we’ve got with Xcite. There’s also, Standard Uranium is working up there, ATHA Resources is working up there, F3 is working up there. So it’s kind of becoming a bit of a, I guess a camp revival if you will. There’s going to be a lot of focus on that area right now.

Matthew Gordon:

Matthew Gordon:

Right. Okay. So how do you go about picking… Because you said earlier on you said, “Look, we do a lot of options and some don’t work, but enough do that it kind of makes up for it.” How do you go about selecting who you want to work with? Xcite I think we know. They’re a sort of 5 million market cap type company. They’re going to have to go and raise some money. Now, probably into a very positive uranium market, that’s not an issue. They’re not going to suffer from perhaps what some of the gold companies would do at the moment. So it’s all good news. But what do you look for in a partner to ensure that they’re more likely to be successful than not?

Chuck Downey:

I don’t know if it’s specifically what we look for. And obviously we try to find somebody who’s got a bit of a track record, able to raise money. And this group I’m very impressed with so far. They have the ability to raise money, they’re very well-connected. But it’s important to structure the deal so that the company can stay in the deal. So typically our agreements are back loaded. The first year, work commitments are usually pretty modest and they keep going up and up and up. I see a lot of companies will do a deal when you read the terms of the deal and this is the richest deal you’ve ever seen. But then the following year, you see they had to renegotiate the deal, they had to amend it because the company, they couldn’t come up with a million dollar cash payment the first year. They couldn’t spend five million in exploration.

So our objective is to get the company there to spend some work. And then the great part about that is even if the deal only goes to one or two years and we get the property back, we’ve got some work on the ground, which is a big part of it. We’ve got the tenure commitments are made, we’ve got a bunch of new knowledge about that project. We can look at the data, package it up and option it out to somebody else.

Matthew Gordon:

Okay. So if it doesn’t work out for them, then you can get a hundred percent back. How do you structure these? It’s really important.

Chuck Downey:

We get a hundred percent back. Yeah. There’s no ownership until they make the first milestone, which is typically 60%. So up until that point, until they make the 60% the first option or second, however the deal is structured, they don’t have any ownership at all. They just give the project back. And we’ve got work on it and we’ve got shares in the company.

Matthew Gordon:

Right. Okay. And again, given the kind of range of commodities, metals that you’re dealing with, you’re just exploration. You’re looking for mineralization of whatever type, and then you find a partner who’s interested in that commodity type. So how much money do you typically spend on these things before you then look for someone to come in and then take it further? What data do you need to provide to give them confidence there’s something there to get going with?

Chuck Downey:

It varies to some degree. It could be on the location, depending how much… If it’s a remote area, it might cost more to get in there to do the work. But an integral part of our business with the project generator is that we have listing properties. So we identify a project that looks like it’s going to have some legs. This is a potential one that we can get optioned out. So we’ll spend enough of our own money so it’ll qualify as a listing project. And if you’re a capital pool company or you want to get your own listing going on the stock exchange, we’ve got projects that have got the minimum requirements on them, so they’re pretty much ready to go. And then we will supply a technical person to write a technical report, and then they can use that as their listing property to get listed on either the CSE or the TSXV. And if you want to get listed, if you want to actually get a trading company, it’s one of the easier routes to go is to do a mining deal.

Matthew Gordon:

Right. Right. Okay. What’s the biggest deal that you’ve done?

Chuck Downey:

The biggest deal that we have done, actually the Xcite one would probably be right up there because it’s six projects and we’ve kind of bundled them all together and they’ve all got their own exploration or their own expenditures. That would probably be one of the bigger ones we’ve done in terms of scale, I would think. Yeah. I would think like 19 million in work.

Matthew Gordon:

Right. Okay. 19 million in work. But in terms of the upside for me as an investor coming in here. I’m trying to make money. So in terms of the value created and how shareholders benefited, what would be the biggest one?

Chuck Downey:

So for the shareholders, these deals we do are great because all that capital goes into the company so we don’t have to go to the market. So you’re a shareholder, you’re not getting diluted. You’re getting exposure to a bunch of exploration work without having to actually be diluted. But as far as the biggest deal we’ve ever done, that sort of comes down to the project incubator because every few years, as I mentioned, we’ve got a group of projects or a single project within the company that we’ve got 30 or 40, 50 projects in there. It kind of gets lost. We don’t really have any value. We’re not getting any market value for that company. So we’ll take that asset out or a couple of assets out and we’ll spin them out into a separate company. So if you’re an Eagle Plains shareholder, you’ve got your Eagle Plains share. And you wake up one morning and as well as Eagle Plains, you’ve got X shares in Spinco that just showed up on your account. You didn’t pay anything for them. It’s like a free dividend.

The objective with that is to isolate these projects, and we do it because we’ve got a partner or somebody that wants to buy them and mine. So the most recent one we did was Taiga Gold. We had an excellent portfolio of gold assets in Saskatchewan. We spun it out into a separate company that was in Eagle Plains. Spun-out a separate company, didn’t affect the Eagle Plains share price at all. Eagle Plains shareholders got shares in Taiga Gold. The company we were targeting was SSR Mining. They had a Seabee mine, a producing mine. Our claims were contiguous with SSR Mining. We did an option deal with SSR. SSR went in and spent I think about 5 or $6 million ($12 million) on that project. And they identified some interesting mineralization. Some of it was close to their current mine boundary, some of it was quite far away. And it got to the point where it was better for them to buy Taiga Gold out than to stay… the base could keep making the deal payments and keep making next wish. So they bought Taiga Gold out.

So that was a really good deal for Eagle Plains shareholders. It was $31 million basically dividend back to the Taiga shareholders. It was cash. Ideally, we really like to do these deals where the Eagle Plains spin-out shareholders get shares in the other company because then they can basically manage their own taxes. They can sell the shares as they want or hold the shares. This case, the only way it worked was a cash deal so it was a little bit different. But that was a big one, $31 million. Copper Canyon was another spin out company that we did, and we sold that to NovaGold for $65 million. And our most recent spin out, which we’ve just completed last year, is Eagle Royalties. And we just took a basket of royalties that we’ve accumulated within Eagle Plains and we spun them out into a separate company and now it’s a standalone royalties company.

Matthew Gordon:

Right, okay. Okay. So I was actually going to ask you about Eagle Royalties. So they’re your royalties in a basket of projects that you’ve generated. Okay, fine. I’ll come back to that in a second. There’s so much going on here. I’m just trying to work out where to focus. Okay. So you’re nimble, you’re agile, you are staying relevant. I’ll stick with uranium for now. That’s a great deal on that uranium project for sure. Okay. So I think there’s something quite interesting. Do you have more uranium? Because right now I’m getting inbound about uranium assets. Most CEOs, uranium companies are getting inbounds about, “Do you have any spare projects?” Have you identified any more potential uranium targets?

Chuck Downey:

Yes, we do. As well as those, our total uranium exposure right now, I think we have 19 uranium projects, about 38,000 hectares roughly. But yeah, we were just down at the Roundup in Vancouver. And yeah, that’s all everybody wants is uranium. Uranium price is a 16 year high right now. Everyone’s looking for uranium projects. Saskatchewan is a great place to work. As well as uranium, we’ve got copper projects there. We’ve also got a Sedex project, got some gold projects out there as well. Saskatchewan is a great place to work. The tenure system is excellent. When you stake claims there, you can hold them for two years without having to do any work, which is very, very attractive. They’ve got excellent geoscience there, a really good database. So as far as doing research, it’s very, very easy to acquire the right data that you want to try to target your research. The government is very supportive of the geoscience there. They fund a lot of the geoscience work out there. They fund airborne surveys, they fund regional mapping surveys. So yeah, Saskatchewan is a great, great jurisdiction.

Matthew Gordon:

Matthew Gordon:

Okay. Interesting. So lots of conversations about uranium, copper, I guess the commodities of the moment. Well, I think the expectation is copper will join uranium this year with that title, that moniker. Okay. Back to royalties, it’s a small basket of royalties. But you spun the company out as a separate public company, relatively small, seven, eight million bucks worth of market cap at the moment. How do you grow that business? Or have you done everything that you need to do with that and your shareholders have benefited already? Or do you have separate growth plans for all of these spin codes that you are in control of?

Chuck Downey:

Ultimately, the other spinoffs we’ve done, we built it so somebody can buy it. So the flagship project in there is Banyan Gold’s AurMac project, which is in the Yukon. It’s got a six (seven) million ounce resource already. And we’ve got kind of a stacked royalty that s from half a percent to two percent on a pretty good portion of the property and a pretty good portion of the property that actually has a resource on it. So that’s kind of our-

Matthew Gordon:

Do they have an option to buy that back or part of that back?

Chuck Downey:

No. No, there’s no option to buy. It’s not purchasable. Yeah. That project’s been in our stable for over 20 years through various machinations. But we’ve always held onto a royalty though. Over the 20 years, we’ve always held onto a royalty.

Matthew Gordon:

That’s worth a chunk of change. Wow. You’re getting value for that, I’ll tell you.

Chuck Downey:

It should be worth quite a bit. Yeah. It’s a great asset. And then we’ve also got some really good uranium assets in Saskatchewan too. They’re a little bit farther up. One important part about this similar to the Banyan is you want to have your royalties in the hands of companies are going to keep the ground in good standing. So we’ve got royalties with Cameco, we’ve got royalties with Denison and other bigger companies like that. And once they’ve got the ground, they’re going to keep in good standing, which is what you want with the royalty. They may not be a discovery this year, but you know that they’re going to keep working that ground and in five years and 10 years, if they keep working it, hopefully there will be discovery on that ground and the royalty is going to be in the money.

Matthew Gordon:

Interesting. Very interesting. Okay. I’m going to have a look at that. Brilliant. Okay. So obviously I’ve got a sense of what you’re about and how you go about it and how I get remunerated, rewarded I should say as a shareholder. It’s a bit spiky, but you keep doing it as a project generator. I like project generation as a concept as well. Okay. So 2024, excited obviously for your uranium contract, but obviously potential for other uranium deals to happen as well and potentially corporate. Anything else I should be looking at?

Chuck Downey:

I don’t think so. Obviously, I think one thing, another part of our business that I haven’t really talked about much, but as you know, the last couple of years has been a bit of a bloodbath for the juniors. Uranium prices are up. We were at the roundup last week. Everyone’s very, very excited about the future, but nobody can still raise any money. So all the juniors are still broke. There’s no two ways above that. Until the equity markets turn around, a lot of companies are going to be struggling. We’ve got a ton of cash. This is when Eagle Plains, historically this is when we really shine because we’ve got the tools and we’ve got the money to go out and make acquisitions, to stake projects, to do work on projects, to get projects into our pipeline, to get it to the next stage so we can get more juniors in there to option the properties.

So yeah, I think it’s going to be a great year for us. I think it’s going to be a fantastic year for Eagle Plains. We’ve got lots of exposure to Uranium. As I mentioned, we’ve got some excellent copper projects in British Columbia. That was the other big commodity focus certainly at the exploration shows this week. And we’ve got excellent copper projects in Saskatchewan as well. So yeah, we’re really excited about this year.

Matthew Gordon:

Well, Chuck, I appreciate you coming on and talking us through that story. It’s not one I had been aware of, but stay in touch please. Let us know how you get on with these various projects of yours and I will go and take a look at the royalty component. That looks like a lot of fun.

Chuck Downey:

Yeah. Great. Thanks, Matt. Appreciate it. Great chatting to you.