We’ve been having some fun with this story. From the “taiga / tie gah / tiger” metaphor geologists use to describe a BIG and VALUABLE new discovery, to kissing frogs in the hopes one will miraculously turn into a prince, it’s almost like we’ve got the makings of a Disney classic movie on our hands.

The exploration agreement between SSR Mining (SSRM, TSX) and Taiga Gold (TGC, CSE) really is a unique one (I can’t stress that point enough). Taiga is the only explorer that has a working exploration agreement in place with SSRM, the world’s best mid-tier miner.

A huge-huge differentiating factor!

This differentiating factor separates Taiga from its entire peer group (in a positive way), and I’ve explained how being a successful speculator in exploration and junior mining stocks requires you to uncover ways to gain leverage cheaply while stacking the odds in your favor.

At the end of this piece you’ll find links to my last two write ups.

So what’s new with SSRM and Taiga?

High-Grade Gold Mineralization Discovered in 3 Separate Zones During Recent Drilling on Taiga Gold’s Fisher Property

“Extremely encouraging” is how I’d describe these results.

However, before I give you the key takeaway let’s consider all the exploration work SSRM has done to reach this point of extreme encouragement. SSRM’s progress thus far is very telling in terms of seeing the future and where all this is headed.

Since optioning the Fisher Property in 2016, SSRM has completed extensive systematic exploration including prospecting, soil geochemical sampling, detailed geological mapping, and geophysical surveys. They’ve accomplished a total of 31,071 m (101,913’) of drilling in 79 holes at a total cost of approximately $CDN 10,300,000.

In 2018 they got some sniffs of gold via the drill bit. Assay results weren’t enough to get Mr. Market excited, but the results were encouraging and we had every reason to believe SSRM wouldn’t stop. Between them and Taiga’s team they’d kiss however many frogs it took to find a 3rd million ounce deposit in Sask.

Then bang! SSRM’s second round of drilling delivered Fisher’s first mineable intercept: 7.3 g/t Au over 1.5 m including visible gold over 6.5 m (highly encouraging).

At the time I speculated whether or not hole #35 might be a watershed moment. We didn’t know for sure-sure, with complete certainty, but we did know hole #35 was a great clue that things were moving in the economic “discovery” direction.

How’d we know?

Simple — 9 g/t Au over 1 m could fit into SSRM’s current mine plan.

Therefore anything better than 9 g/t Au over 1 m is what “success” at Fisher looks like, those numbers became our barometer for success.

Now we know. It’s official, at least in my view, following this most recent drill campaign SSRM has a tiger by the tail (possibly tigers plural).

Recent results were highlighted by 13.7 g/t Au over 2.3 m, including 55.5 g/t Au over 0.53 m.

Twice (2 x) better than what I’d hoped for!

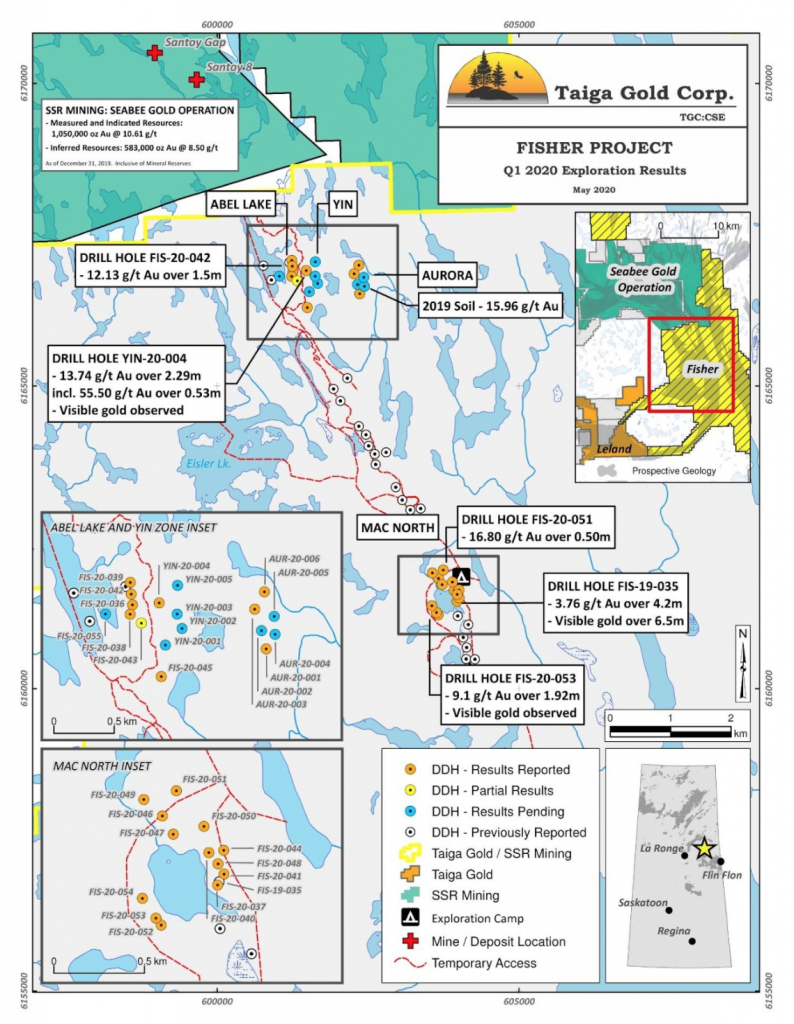

Right now we’re talking about the “Yin Zone”, extremely encouraging results. However, it’s important you keep in mind, within the larger Fisher project context, Yin is 1 of 3 new zones discovered in recent drilling. As you’ll see below Yin is located adjacent to the Seabee Gold Operation boundary (start nearby and work your way south along the 30 km Santoy shear, that’s SSRM’s strategy).

If you weren’t quite onboard with how I described this last news release — “extremely encouraging” — this new map should get you fully onboard.

Extremely encouraging, for sure. No doubt about it. With 13.7 g/t Au over 2.3 m in the Yin Zone (including 55.5 g/t Au over 0.53 m) and 12.1 g/t Au over 1.5 m at Abel Lake we’ve got two holes with mineable widths.

Fantastic news, and it’s just what we know now.

Assays from a 8 additional holes are pending, these include 3 from each of the newly discovered Yin and Aurora zones.

Looking carefully at the new (evolving) Fisher map we can really start connecting dots that weren’t visible before. My eyes are especially drawn to the 15.9 g/t Au soil sample approximately 1 km east of the Yin Zone.

Additionally, you can’t help but look south! I mean holy smokes this Mac North area is a good 10 km south from Yin, Abel Lake, and Aurora on what’s looking more and more like a 10+ km north-south trend along the Santoy shear zone.

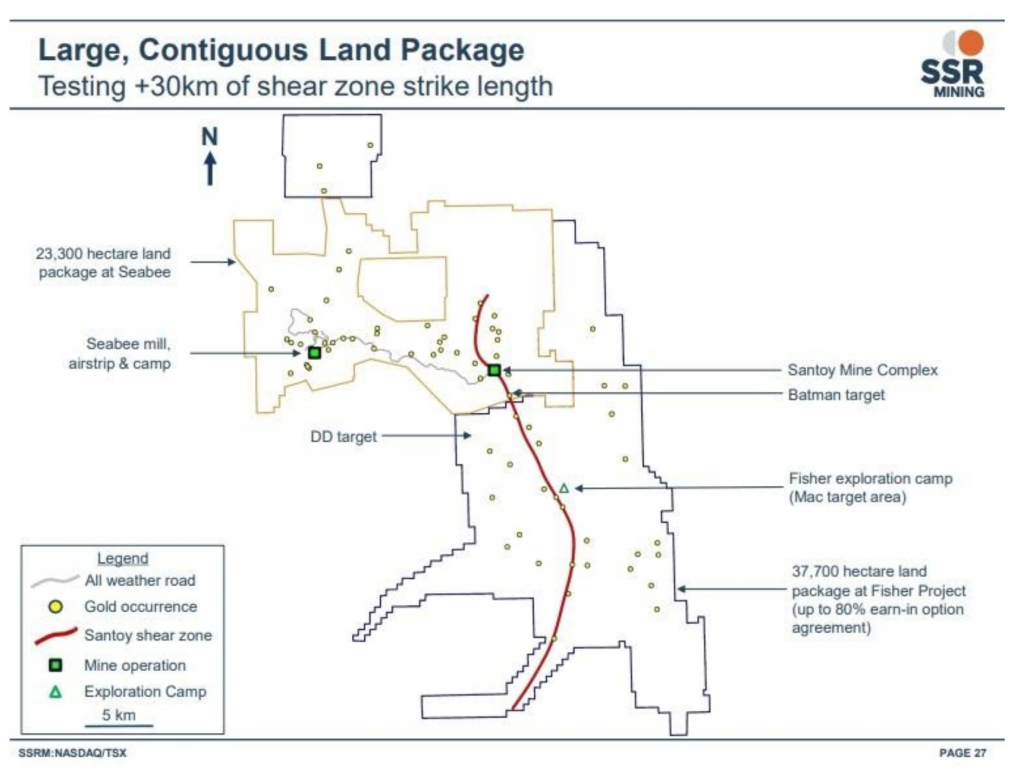

Again, within the larger Fisher project context, it’s important to realize the map above, courtesy of Taiga is only a snapshot of the Santoy shear. SSRM extrapolates the Santoy shear out another 15 km further south to the Mac target area, which has also yielded three intersections of mineable width already despite limited drilling.

I really like this map too, whatever it lacks in details it makes up for by capturing scope and scale.

“We will be drilling there with enthusiasm for the next 4 or 5 years, at least.” SSR Mining’s CEO Paul Benson confidently announced during a live town hall webinar in March

Key Takeaway: Don’t take my word for it. Get your key takeaway by looking at the stock price. Look at what Mr. Market is saying! Since SSRM provided the update TGC has doubled from 15 cents to a new all-time high of 30.5 cents. Heavy volume of 2+ million shares traded confirms the breakout. Psychologically and technically speaking “new all-time highs” is a big deal because basically everyone who owns TGC is in a winning position, and the winners tend to keep on winning.

Quick reminder, in closing, assay results from 8 drill holes are pending. SSRM has budgeted over $4 million in additional exploration expenditures this year (subject to COVID 19 restrictions).

p.s. My next piece on TGC might just dig into the uniqueness of this exploration agreement and what the Fisher project and/or Taiga in its entirety could be worth to SSRM if this all leads to where it seems to be going… M&A. So please stay tuned for that.

As promised, here’s links to more of Daniel’s commentary on Taiga:

https://tickerintel.com/2020/02/26/ssr-mining-i-hear-theyve-got-a-taiga-by-the-tail-in-sask/